Equities broke support into a very sharp decline on Friday. Overnight there has been a limited bounce into 1430, but the overall look is of a bear flag. There is an important support / resistance level at 1432 and a bounce over that would start to look more impressive. It's worth noting here that ES has been making lower highs and lows since the early September high, and if that is to continue here then the move should finish below the last low at 1416.5 ES:

On the SPX 60min the move on Friday took SPX to the bottom of the current six week range rectangle. On a break below there the obvious target would be the strong support area around 1397:

On the SPX daily chart the day closed at the 50 DMA. Lower bollinger band support is in the 1425 area, just under the current October low, and middle bollinger band resistance is at 1446:

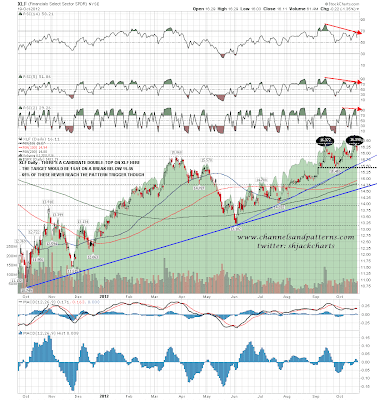

Looking around various indices XLF caught my eye this morning. There is a possible double-top there that would trigger a target at 14.51 on a break below 15.45. 65% of these never make it back to the trigger level but the negative RSI divergence is significant. XLF has been leading lately so this is something to watch:

The last chart today is of AAPL, which I also posted yesterday on my weekend post at MarketShadows, which you can see here. AAPL broke down through the 100 DMA on Friday and, as I said on Friday morning, the obvious target is now the 200 DMA in the 580 area. To the extent that AAPL is a major market mover, that is arguing for at least some more downside on SPX and NDX:

I'm leaning short here, unless we see ES break with any confidence over 1432. We may not go much lower though, as the bounce overnight has set up a possible lower low on positive RSI divergence. I'll be watching for that. There are no usable short term trendlines on ES today so it's hard to give any downside targets. There are significant support levels below in the 1418 ES and 1410 ES areas, and the next big support level is 1388 ES. That may well be tested in the next couple of weeks. Screencast is having problems this morning so I'm having to fall back on the blog images. I'll update those once screencast is working properly again.