Further to my last weekly market update, this week's update will look

at:

- 6 Major Indices

- 9 Major Sectors

- 3 Ratio Charts of the SPX:VIX, RUT:RVX, and NDX:VXN

- A comparison of the SPX to other World Indices

6 Major Indices

All six Major Indices closed this past week lower,

as shown on the Weekly charts below.

The 1-Week

percentage gained/lost graph below shows that the Dow 30 lost the most,

followed by the Dow Utilities, S&P 500, Russell 2000, Dow Transports, and

Nasdaq 100.

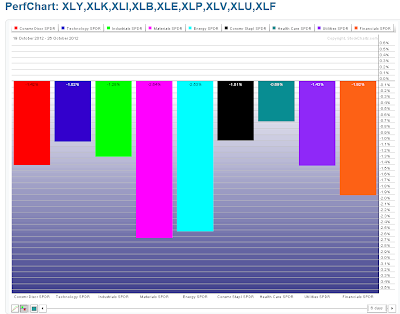

9 Major Sectors

All nine Major Sectors also closed the week lower,

as shown on the Weekly charts below.

The 1-Week

percentage gained/lost graph below shows that the Materials Sector lost

the most, followed by Energy, Financials, Utilities, Consumer Discretionary,

Industrials, Technology, Consumer Staples, and Health Care…with the

"Defensive" Sectors, essentially, losing the least.

Generally, the Major

Indices and Major Sectors are trading around/near their mid-Bollinger Band on

the Weekly timeframe. The next level of support would be the lower Bollinger

Band once they've reached an oversold condition on their Stochastics

Indicator…several are in that vicinity already, but have yet to cross up with

positive divergence. It may take such a situation to occur before any buying

with conviction (and higher volumes) returns to these markets.

3 Ratio Charts of the SPX:VIX, RUT:RVX, and NDX:VXN

On a

Daily timeframe, I'm watching for a break and hold

below the last swing low (on the following three ratio charts

comparing the SPX, RUT, and NDX with their respective Volatility

Indices) to indicate that further selling/weakness is occurring on

accelerating volatility momentum. The Momentum indicator is still in

bearish territory below the zero level on all three charts, and price is

currently in a "bear flag" formation.

SPX vs. Other World Indices

Depicted on the following Daily

ratio charts are comparisons of the S&P 500 Index with

other World Indices. I've drawn in support and resistance levels, as

well as trendlines on price and the RSI, MACD, and Stochastics indicators, which

are self-explanatory. The only comment I will make is a general

observation that the SPX has weakened compared to all of them, either

in the past few days, couple of weeks, couple of months, or from mid-2012. This

is actually shown most clearly on the first chart which compares the SPX with

the World Index…price has been in decline from mid-year, and currently

remains beneath the 200 sma (red).

The big question is

whether the SPX resumes a leadership role compared to these other indices in the

next few days, weeks, or even months. We may see further comparative weakness

until the U.S. election has taken place and the Fiscal Cliff issue resolved.

Either way, it will be interesting to see where the SPX ends up by the end of

this year as either a world index leader or a laggard.

Enjoy your weekend

and good luck next week!