Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

So, Like, What’s My Strategy?

Here are some snippets from an interview from New Yorker magazine with the queen of trading on the cusp, 16-year-old Rachel Fox (as in Stocks; it rhymes, get it?), the shoeshine girl of the modern age. Emphasis added by me.

How did you even get involved in stock-trading?

My parents explained the stock market to me because it’s such a big, important part of life. They didn’t expect me to take such a liking to the whole day-trading idea, though.

So, like, what's your strategy? Do you have a Bloomberg terminal?

Well, I don’t like trading stocks that are very news-dependent. I trade on the technical analyis of stocks. (Lord in heaven, give me strength – Ed.)

Do you trade penny stocks?

OH GOD, OF COURSE NOT. No, I go to Yahoo Finance every morning, that's my thing. And then I go to my trading platform [Scottrade] and do the technical stuff in there. (Because, like, ScotTrade is, like, so awesome. It has, like, the best charts, y'know? – Ed.)

And this is fun?

Definitely. There are certain things making it easier for common people who work and have a day job to do this as well. I'm not just a typical guy who has a suit and goes to Wall Street. My point in writing this blog is not trying to compete with the finance professionals. It’s more just to inspire people to trade.

Who do you go to for investing advice?

Well, um, really … nobody? I mean, I'd have to think about that.

Any people you really look up to? Who's your investing idol?

I heard a story about Warren Buffett, that he has none of his college degrees hanging on his wall. He only has his certificate for public speaking, which is so awesome and inspiring. (Buffett. Naturally. Although I'm not quite clear on why hanging this particular certificate on the wall would give anyone an emotional boner. But, then again, I'm Tim on a Whim, not Fox on Stocks – Ed.) If you can learn public speaking, you don't have to have a ton of education to do well.

You couldn't let go, huh?

It’s hard to master the psychology. You’ve got to know when to step out of things. (Not true, Ms. Fox. You simply have to wait for people who have absolutely no business engaging in a particular vocation professing to be an expert. It's a cinch. – Ed.)

I bet you got a lot of calls after your CNBC appearance.

I'm going to keep those confidential, but there may or may not have been some requests. (Very shrewd, Ms. Fox, very shrewd! Keep those cards close to that chest that the men of America are scrutinizing – Ed.)

So when do you start managing other people's money?

[Laughs.] Maybe I’ll start a hedge fund.

So – – look – – I've got nothing against sixteen year olds. I was one once myself, and at the time, I wrote my first book – the first of a couple dozen, actually (and that first book, incidentally, argued for the importance of computer-to-computer communications and how it would transform the world, way back in 1982 – so thank you very much). But, having done charting for a quarter-century now, I'd rather not be told by a doe-eyed girl how to draw a trendline……..or what stocks to buy (errr, short) for my own hedge fund.

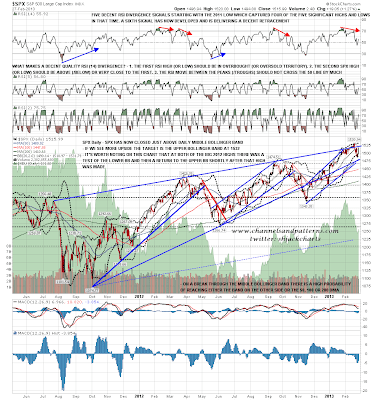

Vix Buy Signal (by Springheel Jack)

SPX took the green pill yesterday, breaking over the double-bottom trigger level and making the double-bottom target and more by the end of the day. Is the retracement low then in? Not necessarily but the odds that the low is in have obviously increased considerably. On the SPX daily chart it's worth noting that both of the main highs in 2012 were followed shortly afterwards by retracements to the lower daily bollinger band and bounces back to the top. However I don't think the current high was a main high. SPX closed 5 points over the daily middle bollinger band and if we see more upside the obvious target is at the daily upper bollinger band in the 1532 area: