Shaking Out The Herd

In a Slope post on Tuesday ("30.2 Yield Curve And Gold"), Gary Tanashian noted that, "over the last 1.5+ years gold has shaken out the herd". Our host Tim, not one to follow herds, reminded us on Tuesday that he's currently long gold via GLD ("Target on GLD Long Approaching"); nevertheless, according to Reuters, more GLD herd members did get shaken out last month, with the gold ETF seeing a billion dollars in outflows in January. In this post, we'll look at a couple of updated hedges for GLD. First, though, a note about Bernanke's testimony yesterday, and an interesting gold chart Bespoke Investment Group posted in response to it.

Gold And Bernanke

Possibly the most widely-quoted part of Federal Reserve Chairman Ben Bernanke's Senate testimony on Tuesday was this exchange between the Fed Chair and Senator Bob Corker of

Tennessee, in which Sen. Corker called Bernanke an inflation dove, and

Bernanke retorted that inflation probably has been lower during his

chairmanship than any other time in the post-war period, averaging about

2% annually (I wrote "probably" there because Bernanke hedged his statement a little).

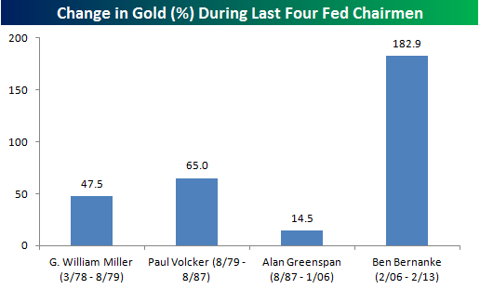

In response, Bespoke Investment Group posted the chart below, showing the performance of gold under the last four Fed Chairmen.

Bespoke Investment Group concluded,

For those who use gold as a gauge of the dollar's true purchasing power, Bernanke's statement doesn't hold much weight.

Eliding Secular Markets In Gold

Bespoke Investment Group's conclusion is true, as far as it goes, but

it elides the secular bull and bear market trends in gold over the time

frame of its chart. Of course, a secular bull market in gold peaked in

1980, and the next secular gold bull market didn't start until about 22 years later.

Volcker's chairmanship includes the final run-up to the 1980 peak, and Greenspan's

chairmanship includes most of the secular bear market in gold; someone

who looked at Bespoke Investment Group's chart without knowing any of

that might be misguided into thinking that Greenspan was an inflation hawk and Volcker a dove.

Hedging GLD Now

Gold and the GLD,

the most widely-traded gold ETF, both rose on Tuesday as Bernanke

testified, with GLD closing up 1.2% on the day. Nevertheless, GLD is

down about 10% from its 52-week high, and it's down nearly 15% from its all-time peak in September, 2011. Despite that, and despite GLD's recent outflows, the ETF is still quite cheap to hedge.

Two Ways To Hedge GLD

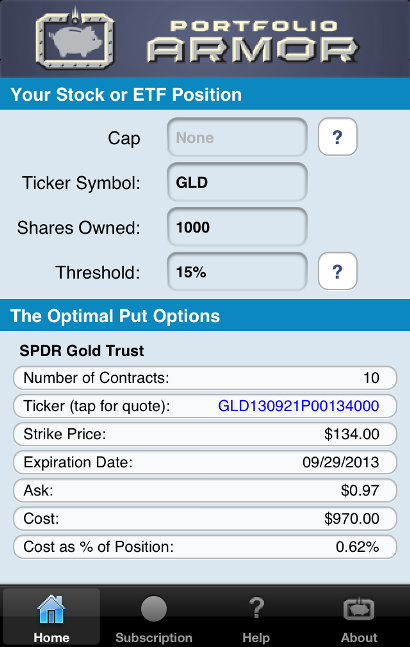

Below, we'll look at

two different ways of hedging GLD against a greater-than-15% decline.

The first way uses optimal puts*; this way has a small cost, but allows

uncapped upside. These are the optimal puts, as of Tuesday's close, for

an investor looking to hedge 1000 shares of GLD against a

greater-than-15% drop between now and September 29th:

As

you can see in the screen capture above, the cost of those optimal

puts, as a percentage of position value, is 0.62%. Note that, to be

conservative, cost here was calculated using the ask price of the

optimal puts; in practice an investor can often buy puts for a lower

price (i.e., some price between the bid and the ask).

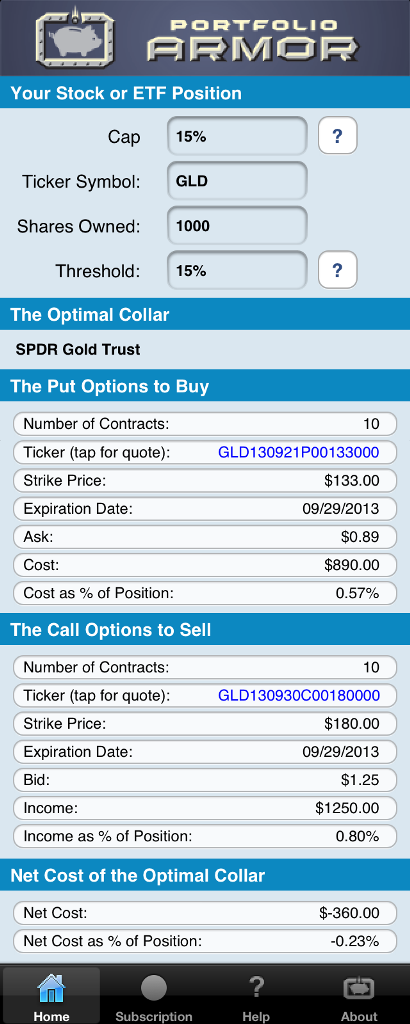

A GLD investor interested in hedging against the same, greater-than-15%

decline between now and September 29th, but also willing to cap his potential

upside at 15% over that time frame, could use the optimal collar**

below to hedge instead.

As

you can see at the bottom of the screen capture above, the net cost of

this optimal collar is negative — meaning the GLD investor would be

getting paid to hedge in this case.

*Optimal puts are the ones that will give you the level of protection you want at the lowest possible cost. Portfolio Armor

uses an algorithm developed by a finance Ph.D to sort through and

analyze all of the available puts for your stocks and ETFs, scanning for

the optimal ones.

**Optimal collars are the ones that

will give you the level of protection you want at the lowest net cost,

while not limiting your potential upside by more than you specify. The

algorithm to scan for optimal collars was developed in conjunction with a

post-doctoral fellow in the financial engineering department at

Princeton University.

The screen captures above come from the latest build of the soon-to-come 2.0 version of the Portfolio Armor iOS app. Optimal collar capability will be available as an in-app subscription in the 2.0 version of the app.