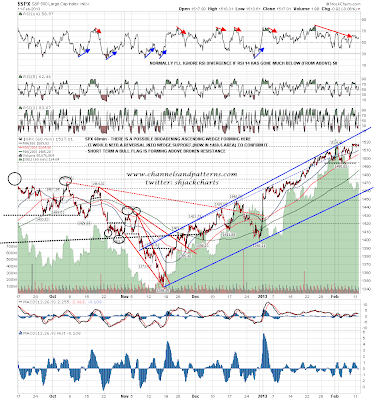

Markets were looking somewhat schizophrenic yesterday morning but that's not the case today. SPX spent a dull day forming a bull flag above broken resistance. The next obvious move is upwards into the 1520s:

AAPL tested falling wedge resistance yesterday slightly lower than I had estimated at 485. This is an important moment of truth as if AAPL can break up here then the bottom should be in. There is a little play in the resistance trendline but if AAPL breaks over 500 then that will be a clear break up. Equally if the downtrend is going to resume, this is the place:

Looking more closely at the declining channel on EURUSD it is actually a bullish broadening ascending wedge. Wedge resistance was tested overnight, and here too this is an important inflection point. I'm strongly favoring a break up, as EURUSD has formed a perfect IHS at the lows and that has already broken up with a target in the 1.3525 area:

The H&S that we have been watching form for a couple of weeks on CL completed yesterday and pinocchioed the neckline slightly. As with double-tops this is where these patterns fail when they fail and we have since seen a very strong reversal back up. CL has broken strongly back over 97 and the next obvious target is the current highs just over 98:

TLT still looks like a possible bottoming setup. I have short term trendline support in the 116.5 area and if that breaks the downtrend should resume. Until then though the obvious upside target is in the 117.8 to 118.2 area, and a break above that area would open up the gap fill into 119:

If EURUSD can break wedge resistance, and with the current exception of TLT, everything is pointing up for equities today. I have strong support on ES at 1511 and 1509. If we see the 1525-30 SPX area made that would be a nice short entry level as that is close to the likely high for the week if it resolves bullishly.