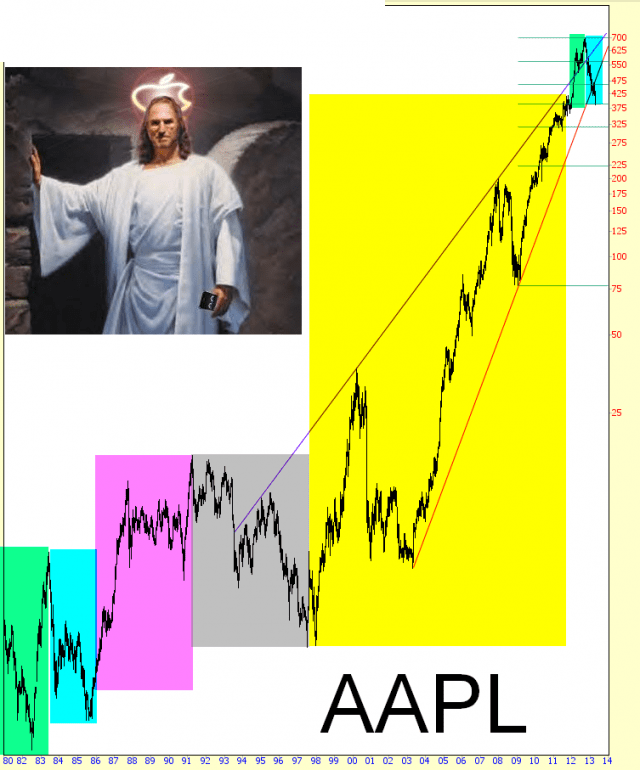

I know that the Cupertino-based tech giant has been talked to death, but my relationship with Apple is, I think, a fairly special one, so I wanted to share my own view as to the principal phases the company has been through over the years of its public ownership. I’ve laid out the entire price chart of Apple from its IPO to the present day and have tinted what I consider the main eras:

IPO and Macintosh Magic (green) -In December 1980, Apple went public in what is widely-regarded as the most anticipated IPO since Ford went public in the 1950s. It was very much the Facebook of its day – – new, exciting, led by a ridiculously young and charismatic man, and it was the place smart, ambitious techies wanted to work. Although the price ground lower for a long time after the IPO, the prospect of a breakthrough new computer (the Macintosh) pushed the stock well above its IPO, and it was again the darling of the market.

Lemmings Plunge (blue) – In a textbook case of “buy the rumor, sell the news”, the introduction of the Macintosh marked roughly the peak of the company’s stock, and disappointing Mac sales – – as well as a general slump in personal computers – – took a lot of the air out of AAPL. After a while, the company was perceived as foundering, and as it neared its lifetime low, the company gave co-founder Steve Jobs the heave-ho, and John Sculley took over.

Sculley Surge (magenta) -After Jobs was out, Sculley took full charge of turning the place around, and the investing public liked the fact that an “adult” was finally running the place. This coincided with the surge of desktop publishing, which pretty much saved Apple in the mid-1980s, and a series of more powerful Macintoshes shored up sales and profits. The stock peaked with the stock market mania of 1987 and pretty much ambled around aimlessly for the next four years.

Amelio Anemia (grey) -This is surely the saddest, lamest time of the company. After Sculley left, a series of Dumb White Guys kept going through the revolving door of senior management. The names are just footnotes now, but they were all clueless, lame, and had about as much charisma as a school bus fire. The company had gone from cool and cutting edge to irrelevant and sad. But then, as everyone knows, it was time for the……..

Glorious Return (yellow) -Steve Jobs comes back (which I detailed in depth with a nearly one-hour video I did for Tastytrade). Entire books have been written about this era. Suffice it to say the stock went up thousands and thousands of percent, and Jobs created hundreds of billions of dollars of shareholder value. When Jobs died in October 2011, the stock was at about $400 (which happens to be where it is right now), and some feared that with Jobs gone, the company and its stock would shrivel.

Post-Mortem Momentum (green) -But, on the contrary, the momentum Jobs had created lasted after he was gone, and concerns about his death “killing” the company were swiftly dispatched. The stock shot past $500, $600, $700, and many analysts (detailed, for instance, here) predicted Apple would easily tag $1,000/share. Some even went so far as to target $2,000/share, perhaps just to outdo the other analysts.

Your Goose is Tim Cook’d (blue) – However, since last September, Apple has become a whipping-boy. Many far-sighted analysts called for Apple to crumble to $390 (EDIT: actually, it was just me), and last night, one could be forgiven for thinking the worst was behind the company. After all, the stock surged about $25 once earnings were released. But, as I’m typing this, Apple is actually slightly in the red.

So what’s next for the company? Personally, I think it’s going to be a repeat of the “Amelio Anemia”. The company’s shares will slowly grind their way into the 300s, really not doing much of anything, and the stock will go the way of Cisco and get less and less interesting. There will come a day when the Apple earnings announcement garners as much fervor as the release from Intel. In other words, they’ll continue to be seen as an important element of the Silicon Valley, but they will hardly be the center of attention that they were in the past.

Even now, the days when people would line up days before a product was introduced just to be one of the first buyers seems quaint and a little sad. I’m afraid the glory days for Apple did indeed leave with Mr. Jobs. Some other company will take its place as the Shiny Pebble that the public requires.