It has been a pretty wild week, fortunately the ranges have been relatively well defined. Currently the short term daily trend is still to the upside and there is an open profit target at 1666.25.

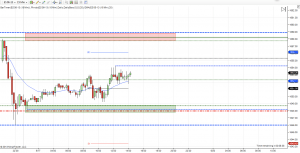

Resistance for today: Value Area High- 1657.75, Low volume node- 1658.25, yesterday’s high- 1658.75 and ultimately the swing high of 1659.75.

That resistance zone is at the upper end of our multi-day volume profile, a rejection here represents a failure to make a new high and a rejection of upper value. The key levels out of this zone are the daily R1 pivot at 1656.25 and the volume point of control from yesterday at 1655.25. This should bring in buyers, also note the gap size, which is so far is not favoring a gap fill. What this means is all shorts in this zone are counter trend and should be managed accordingly.

Support for today: High volume node- 1647.75, Weekly R2 pivot – 1648.00, Overnight low- 1648.25 and the 4:15pm Gap fill- 1648.50

This marks support in an uptrend and again the scene of the crime from the previous breakout. The gap fill should start to slow down any downside momentum and the value area low at 1652.25 is a key area to overcome for longs, sellers should step up at that area which is also below the daily pivot.

Notations: Overnight session is up trending. OPEX. If the gap is between 5-10pts the probability of a fill drops to 56%. News at 9:55 EST.

Here is the chart:

Hopefully my analysis has proven to be thought provoking and helpful. This weekend I will do a “this week in pictures” to show the before and after for the entire week of each day’s prep work. Good luck out there today!