I was expecting yesterday’s post to be a bit controversial and it was. However the job of the analyst is to see the evidence, assess it, and analyze the relevant data to reach a conclusion. This might be described as the SAA method. If you reverse this to start with your conclusion, you risk making an AAS out of yourself. 🙂

Occam’s Razor is the proposition that when there are a number of competing hypotheses to solve a problem, then the simplest hypothesis is likely to be the correct one. In essence this is a mathematical expression of the truism that if something looks like a duck, sounds like a duck, and acts like a duck, then it’s probably a duck.

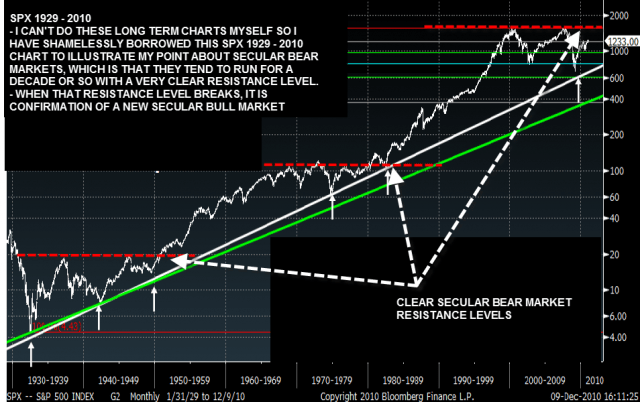

There is a simple visual marker for identifying the starts and ends of secular bear markets, which are long periods of retracement/consolidation that encompass multiple primary or cyclical bull and bear markets, and that marker is that during that secular bear market there is a clear resistance area on SPX (and Dow for further back than the 1920s). The break over that clear resistance area is a strong signal that the secular bear market is over, and the first break on the chart below just after 1950 signaled a bull move into the late 1960s, during which time SPX rose 500% from the resistance break, and the second break just after 1980 signaled a bull move into 2000, during which time SPX rose over 1000% from the resistance break.

Now it might be different this time (ahem), and equally we could be seeing a short lived false break above resistance like the one in 1973/4, but this is a long term signal that cannot just be ignored, and I have been re-assessing the outlook from here in the light of this very strong long term bullish signal. That will be the uniting theme of a series of weekend posts over the next few weeks considering the likelihood that we are in now a secular bull market that should run considerably higher from here.

Here is the long term SPX chart showing these secular bear market resistance levels. I can’t chart back further than 1980 myself so I have shamelessly borrowed a chart from the web this morning covering the period 1929-2010 on SPX. Obviously the resistance level for the latest secular bear market has now been broken:

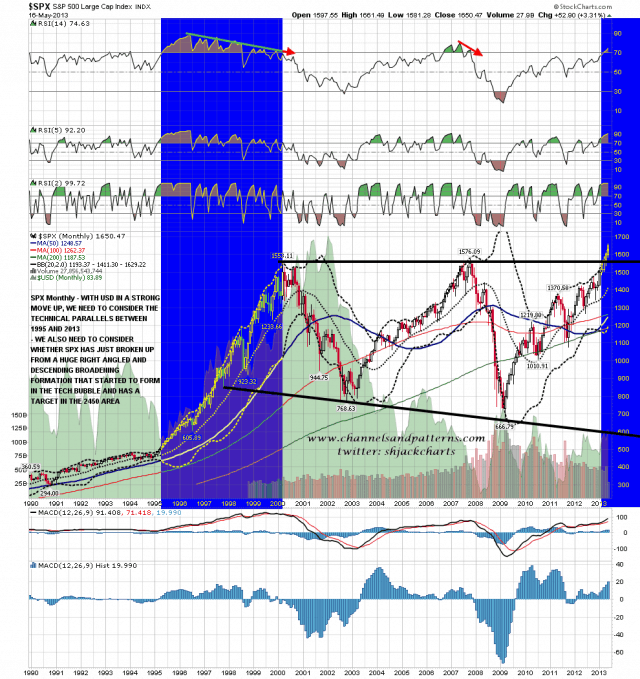

In terms of the pattern I was showing on the SPX monthly chart yesterday, that was a right angled and descending broadening formation, and these aren’t high probability patterns. I would say though that the last decent one of these that I charted was on AUDUSD a couple of years ago, and that broke up and made target and then some. The target for this one would be in the 2450 area. Just sayin’:

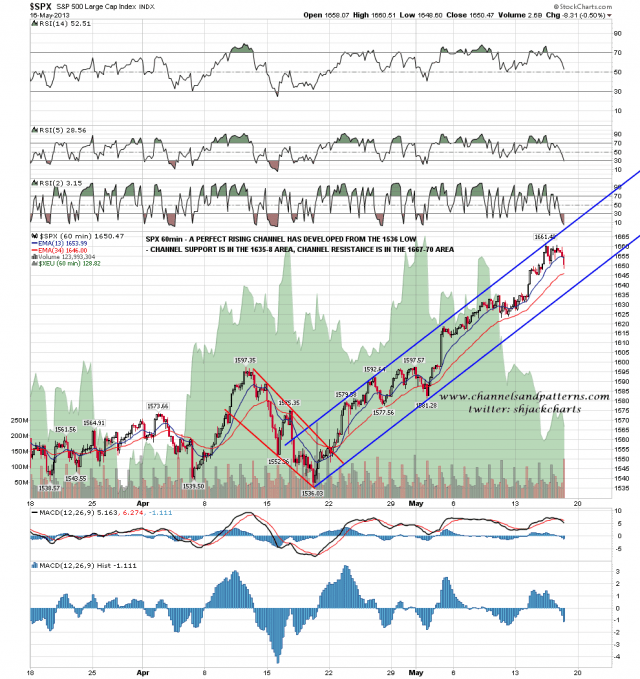

Back in the short term the SPX weekly upper bollinger band is now at 1645, and should finish today in the 1645-50 range that I gave a the start of the week. As I have said, a close much above this today would be rare, so I would expect a close no higher than 1660. Will we see the three week consolidation that I’m looking for here? Possibly, but I’ll be looking at that on the next chart. Here is the weekly SPX chart:

I mentioned yesterday that I had a shorter term SPX rising channel that was holding, and I’m going to look at that in more detail today. That channel is from the 1536 low, and rising channel support and resistance are now in the 1635-8 and 1667-70 areas respectively. Rising channel support is the obvious next target but if we are to see a longer consolidation period, obviously this perfect rising channel will need to then break:

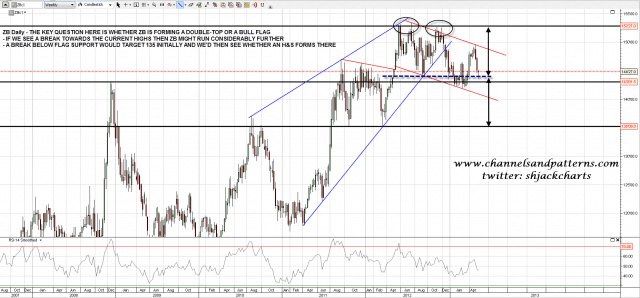

I posted a chart yesterday morning on ZB daily showing the current inflection point area there as either a double top or a bull flag. We’re still waiting for a definitive break either way:

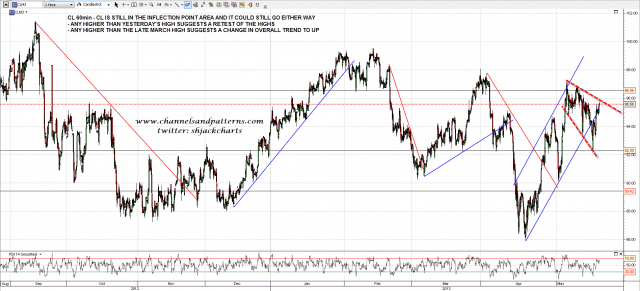

Oil is in another inflection point area waiting for a definitive break. I would see a definitive break up as being over the late March high just above 98 on CL:

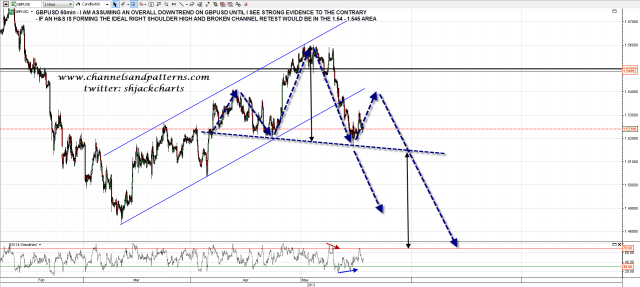

I mentioned a few days ago that there might be a bounce soon on GBPUSD to retest broken bear flag support. That bounce may be starting as a right shoulder bounce on a downsloping H&S and the ideal high would be in the 1.54 to 1.545 area. I would be seeing that area as in ideal short entry area:

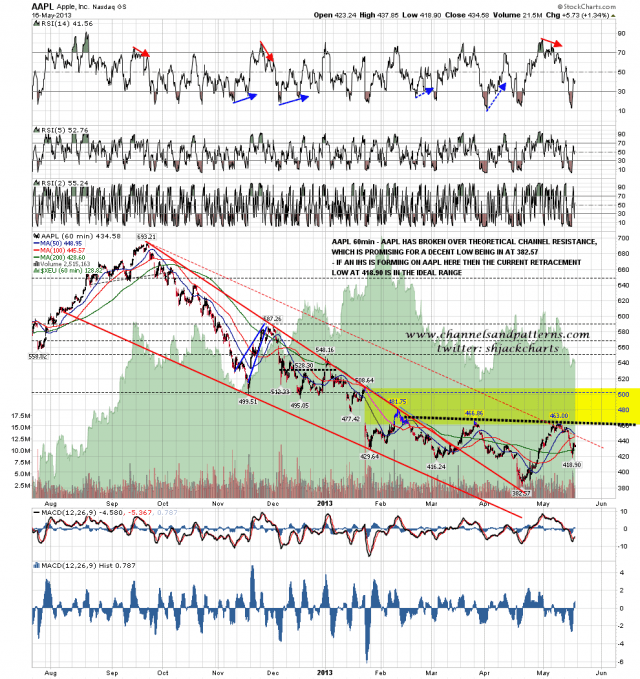

My last chart today is AAPL, where an IHS may well be forming. Yesterday’s low was in the ideal area for the right shoulder low. Personally I think AAPL looks comparatively cheap here:

The chart to watch today and until it breaks is the SPX 60min chart with the perfect rising channel from 1536. Channel support is the obvious next target, and if we are to see a multi-week consolidation here, obviously that channel support will need to break.