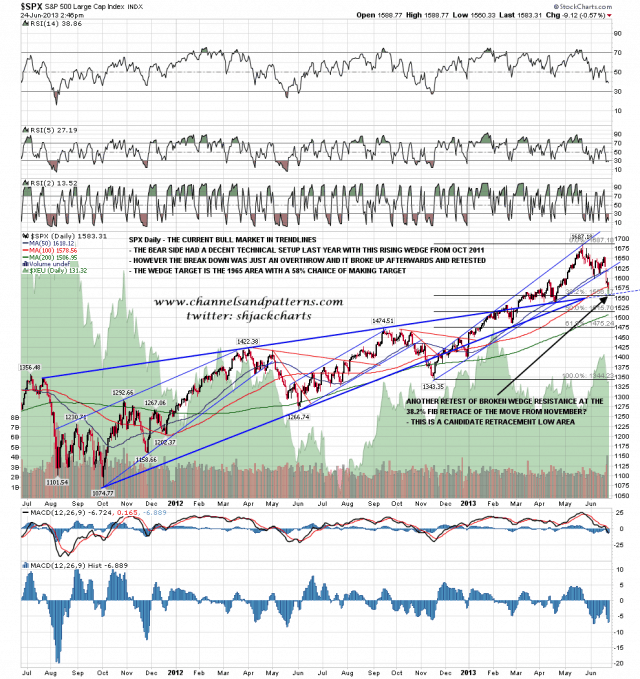

I posted a chart on twitter yesterday showing the intraday low, and showing that it was a possible retracement low as it was both a test of broken rising wedge resistance (target 1965 area) and very close to a 38.2% fib retracement of the move up since November. Since then a bounce on ES has been trying to get established. Here is that chart that I posted intraday yesterday. SPX daily chart:

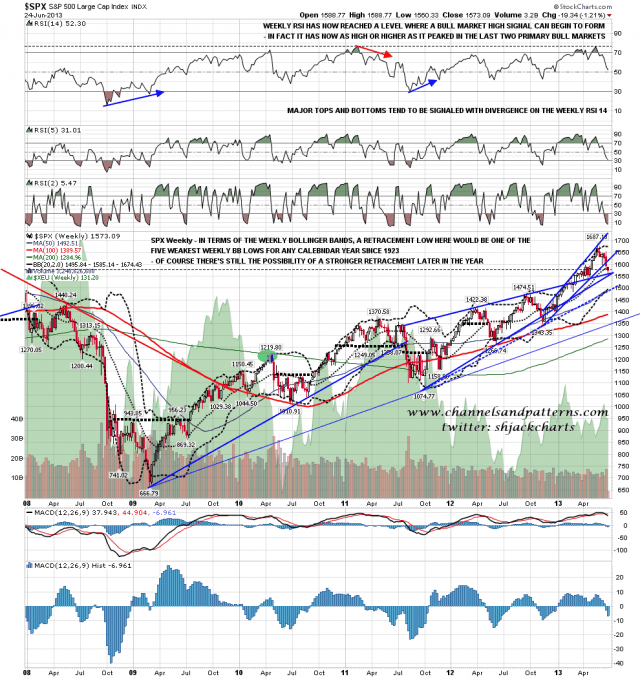

I am not keen on this area as a low, and if it was the low, and we didn’t see a break below the weekly middle bollinger band later in the year, then this would match the very weak retracement seen on SPX previously in only four calendar years since 1923. Those years were 1995, 1954, 1928 and 1927, and if I exclude years where the previous calendar year closed down, that would leave only 1928 and 1927, and with Dow (though not SPX) having closed down in 1926, the only previous instance with a strong rise in the previous year would be 1928 out of the last 90 years. That said there were no previous years with QE running throughout the year so it is possible that we might see this rarity again in 2013. SPX weekly chart:

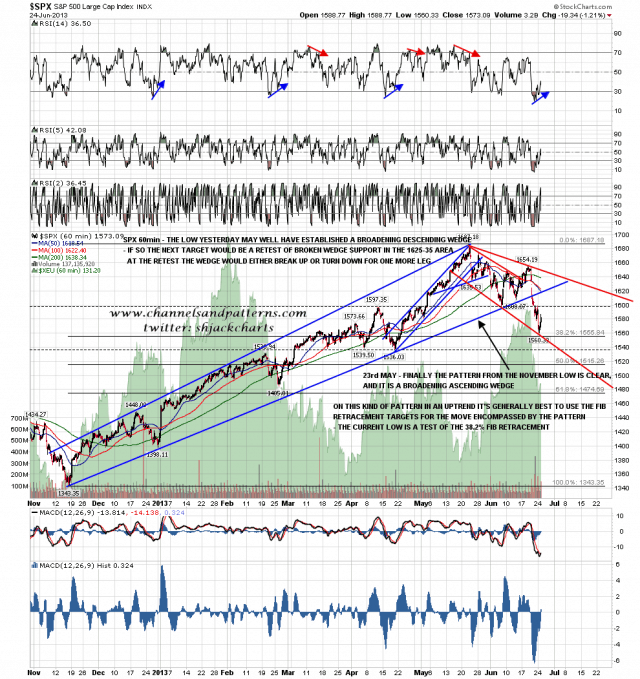

On the SPX 60min chart we had strong positive RSI divergence at yesterday’s low, and a possible broadening descending wedge has formed. Resistance on this chart is at the possible IHS neckline at 1597/8, and broken wedge support currently in the 1620 area (and rising). You can see on this chart that yesterday’s low was 4 points shy of the 38.2% fib retracement, which isn’t exact but is close. SPX 60min chart:

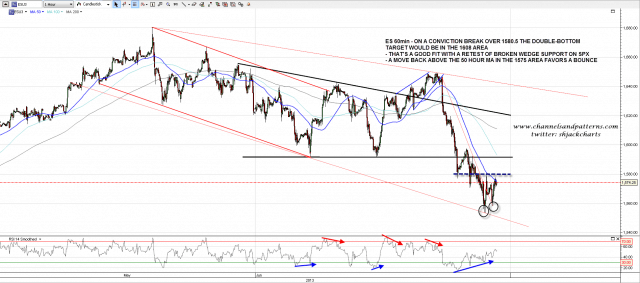

When I capped the ES chart below ES was still testing the 50 hour MA at 1575, and that was an obvious point of resistance. That has since broken and I have a possible double-bottom in play with a target in the 1608 area on a conviction break over 1580.5. The positive RSI divergence kept increasing over the day yesterday and seems likely to deliver the promised bounce now. ES 60min chart:

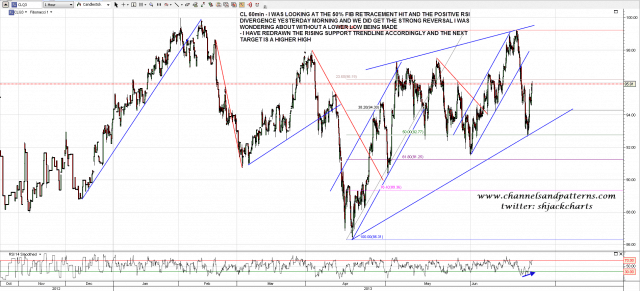

On CL yesterday morning I noted the test of the 50% fib retracement for the move from April, the failure so far to make a lower low, and the positive 60min RSI divergence, and CL has bounced hard from there. I’ve moved the support trendline accordingly and am looking for move above the last high next. CL 60min chart:

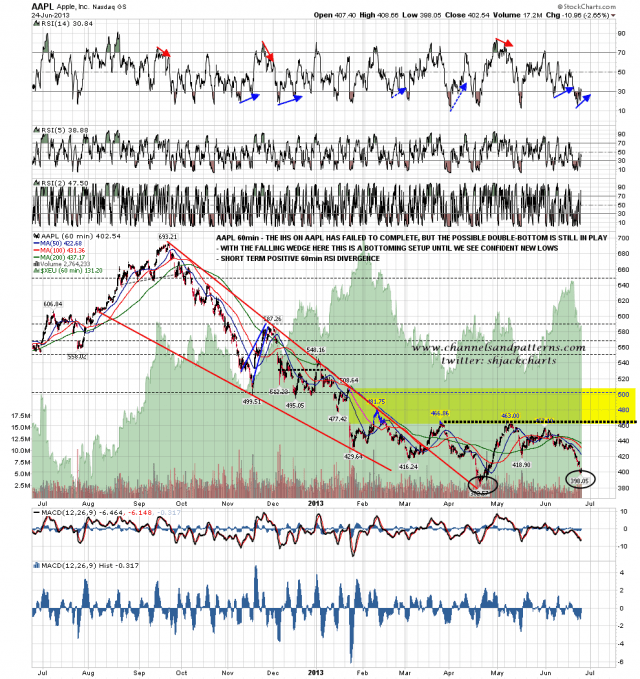

The AAPL IHS was looking extended and AAPL has broken down to a level where the pattern formed would no longer be an IHS, it would be a double-bottom. Given the bullish nature of the falling wedge that broke up, and the fact that AAPL still looks pretty cheap, I’m assuming that this is a bottoming setup unless we see a strong new move downwards begin. AAPL 60min chart:

My chart of TLT that I posted in March with a projection for the following twelve months is still looking good, and TLT has now reached the high end of the area where I was expecting a large bounce to begin that would last into the end of the year. It may not happen of course but I still like the overall setup. TLT daily chart:

I like the odds for a bounce here and if ES can hold above the 50 hour MA then I am expecting to see one. I am concerned about the possibility that the retracement low may now be in, but we’ll know more about that soon as this likely bounce develops.