It’s the water that goes first. In natural disasters, the status of clean drinking water moves from a take-it-for-granted commodity to a premium commodity. For the first time in 93 years, the city where I live is in a State of Emergency. Historic flooding here in Calgary and elsewhere in Southern Alberta has affected everyone in some way. Ironically, it is the presence of too much water that has caused people to panic about drinking water.

There is a surreal atmosphere as life continues amid this disaster. At the beginning, when disbelief was still the predominant emotion, I watched has colleagues in meetings received urgent phone calls from their spouses or children. The message was the same. The police had just come to the door with an urgent and disruptive command: “Your community is under mandatory evacuation. You have to leave. You have 30 minutes”. Then on social media I read about the same thing happening to friends and their friends. I am on high ground but I have friends just a few kilometers away who have been evacuated. One of the hardest hit areas is just down the hill from me – a community where my son attends High School. His school friends are not in their homes.

The destruction from the flood is significant and not yet fully understood. The loss of property and damage to infrastructure will be billions of dollars. Great losses, like those in trading, often start small. It is the subsequent acceleration of uncontrolled losses that bring about disaster. Like the rains of the past few weeks, it was initially nothing more than an annoyance. But then a small community upstream had something unusual happen: their creek had turned into a river. That river began to tear away at roads and homes along its path. In a few hours, the damage and loss became more severe. A few hours later, people in that community were trapped. The exits were gone and they were under water.

The next morning in Calgary, it became clear that overnight the event risk had increased. The floods were here and people began to panic. I received an early morning call from a much stressed sister who was trying to purchase water from Costco. She stood in an extremely long line and reported that when the doors opened, people ran for the water. She asked if I wanted a case. I didn’t. Grocery store parking lots were full and gas station lines became long as one station reportedly ran out of gas.

There was never any shortage of gas but the twitter storm and Facebook postings became more urgent, more panicked and more unreliable. Some posters claimed that food trucks would not be able to get through. Media passed unconfirmed reports fearful things. The rumor de jour shifted constantly and misinformation relayed through social media was perceived by others as fact. The noise level ramped up and signal became obscured. In grocery store parking lots, people followed shoppers to their cars just so they could get their cart. While I was at the cash register buying a newspaper at a local gas station, a man urgently went past the people in line to the cashier and breathlessly asked the clerk “do you have any bulk water?” The answer was “we are sold out” and with that, he hurriedly left in search of someone else who might sell him water. He will be able to buy water, but he will pay a substantial premium for it. Such is the nature of demand and supply.

I didn’t need water. I hadn’t foreseen this particular risk and very few people here have witnessed anything like these floods. But I had planned for it (or something like it) and I had several hedges in place. I already had four flats of water bottles in the garage. Should a temporary risk event cause the water services to shut down, those water bottles were my stop loss. My deeper hedge was with my food storage where I have six water containers each containing seven gallons of water. My risk of ruin was improbable since I have a water filtration system designed for emergencies. I could produce clean water from rain water or water in rivers and lakes. In a flood, there is lots of that around. In this unexpected event, I knew where my risk was.

What I am witnessing in The Great Flood of 2013 is no different than what I have seen in financial markets. Unpredictable events happen. Hope and fear in a panicked grocery store are no different than the hope and fear exhibited by traders. Exogenous circumstances can lead to events that no one can control. Traders can no more control the markets than society can control the floods. But you can manage risk. When it comes to trading, you cannot manage return. You can’t tell the market what to give you anymore than you can tell a flood which direction to take or which home to destroy. You can only manage risk. However, when the floods come and the panic sets in, the time for planning is gone and an orderly exit from the crowd is not possible.

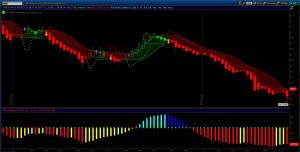

Below is a chart of the SPX. We have a new signal. After 25 weeks of a rising market, both the stop and lower momentum band have triggered. The warning signs have been in place for several weeks and I have discussed them in previous posts. For some, this is a signal to short. This is the most risky and for many traders, shorting is much more difficult than going long. There can be vicious and scary retracements. Also, we have been in an environment of shallow dips and our monthly charts are bullishly postured. For longs, it is a signal to get out. There is nothing wrong with being out of the market. Not trading is trading. For those wanting to swing short this market, we know where the risk is. A weekly close above the upper momentum band at 1650 is the first line-in-the-sand and the short stop at 1677 is last exit. Long Puts are the conservative way to play the short side as long as you know what you are doing with options.

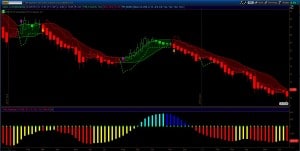

My comments on gold are the same as they were last week. The charts below of GC, GDX and GDXJ are in a downtrend and there are no buy signals.

Last week, I discussed EEM. Nothing has changed. It is still in a strong downtrend (no upper wicks). The chart is below.

Stay Dry and Have a Good Week!

-Dr.G