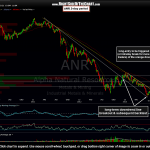

ANR will trigger a long entry on a break above the downtrend line on the daily chart below. When trading breakouts of price patterns, waiting for confirmation of a closing print on the time frame of the chart that you are trading will help minimize getting sucked into buying (or shorting) a false breakout (or breakdown). e.g.- If trading off a pattern on a weekly chart, you would wait for a Friday close above the pattern before establishing a position. The flip side to that is the fact that most technical patterns, such as bullish falling wedges, are like coiled springs: as prices compress towards the apex of the wedge, “energy”, if you will, builds in the stock. Once a breakout occurs, the stock will often explode higher on high volume as new buyers pile into the stock and shorts begin covering. The above average volume and large percentage move then gets picked up via scans & other “eyes” looking for stocks on the move, shining light on the stock and bringing in even more buyers… at least that’s how a text-book breakout occurs (sharp price gains and above average volume following the breakout).

Therefore, more aggressive traders might prefer to enter a long position on a stock like ANR immediately following an intraday break of the downtrend line while more conservative traders might prefer to wait for confirmation of a close above the pattern. The advantage to the former strategy would be an optimal entry price, should the stock continue to move sharply higher following the breakout while the downside would be more whipsaws and losses from taking breakouts that fail, as one would typically be stopped out shortly after entry once the stock moved back below the breakout level.

Based on my analysis of ANR, especially considering the technical posture of the weekly chart, I believe that an upside breakout in the stock is likely to happen very soon and as such, my preference on this one would be to establish at least a partial position on an intraday breakout above the daily downtrend line. Stops TBD upon entry, targets marked on the daily & 2-day charts. Due to the above average potential gains and expected holding period to the final target (68%+), ANR will be added as both a Long Setup (a typical swing trade) as well as a Long-term Trade Setup (trades geared for longer-term traders and investors).