September expiration has finally passed us by.

It was a rather smooth month until Helicopter Ben stepped in this past Wednesday. Of course, the bulls were certainly more than ecstatic about the results. But, the move was short-lived and as we enter post triple witching we should expect to see further declines. On second thought, Ben’s message might have been one of the best things to happen to the bears in quite some time.

Couple the aforementioned with the fact that we are witnessing record inflows into funds and you start to get the sense that the bears might have a turn here.

According to Lipper, more than $30 billion has flowed into equity funds over the past two weeks, when we include both mutual funds and ETFs. That’s the largest two-week sum in at least 10 years. The previous high was $28 billion in early July.

In the past, when we have seen such sharp inflows the market was near a multi-month collapse. I’m certainly not going to go out on a limb and say I expect the market is going to begin tanking. But it’s hard to deny that the pot odds are with the bears at the moment. And in reality, I am only concerned about how the market reacts over the next 20-50 days. That’s where I make my money. I can wrap probabilities and thereby a strategy around that time frame. Anything else is just a guessing game. There are still a few good trades on the board.

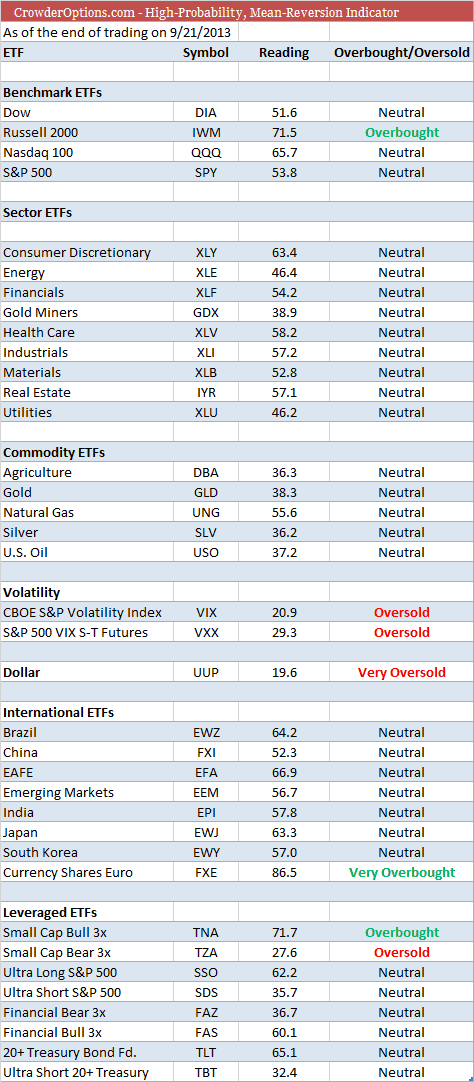

I made several trades last week for subscribers, but I might add a few more in the coming week particularly if we see another early push higher. Both IWM and FXE look very good right now. I wouldn’t be opposed to selling premium in the VIX or VXX either.

If you are a believer in a statistical approach towards investing please do not hesitate to try my options strategies. I use simple mean-reversion coupled with probabilities for each and every trade. Give it a try, it’s free for 30 days.

If you haven’t, join my Twitter feed or Facebook.

Kindest,

Andy