Happy New Year everyone! I hope everyone had a good holiday.

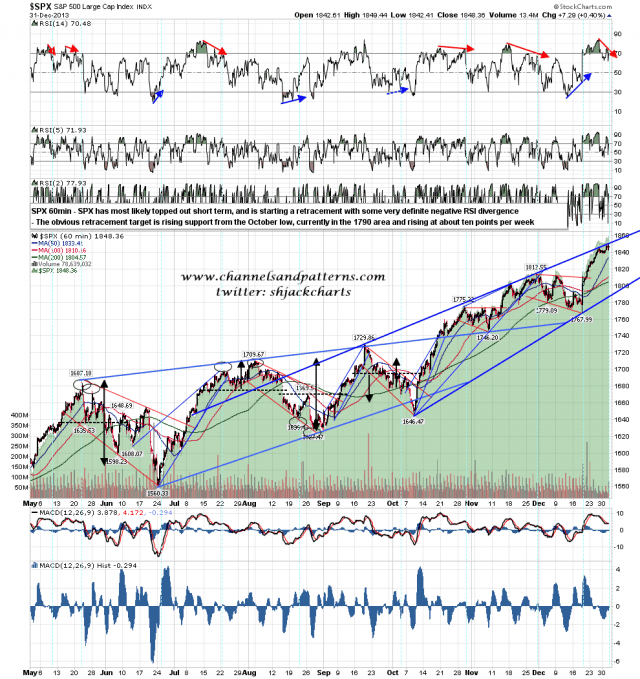

I was looking for signs of a short term high last week and I’m now seeing some. There is very marked negative divergence on the SPX 60min RSI and I have the current highs at a possible rising wedge resistance trendline from the October low at 1646. The obvious target for any retracement from here would be rising support from that low, now in the 1790 area and rising at about ten points per week. We may see a retest of the current highs today, and I’m still looking for for a larger topping pattern here than the obvious short term double top targeting the 1835 area on a break below 1842 today. SPX 60min chart:

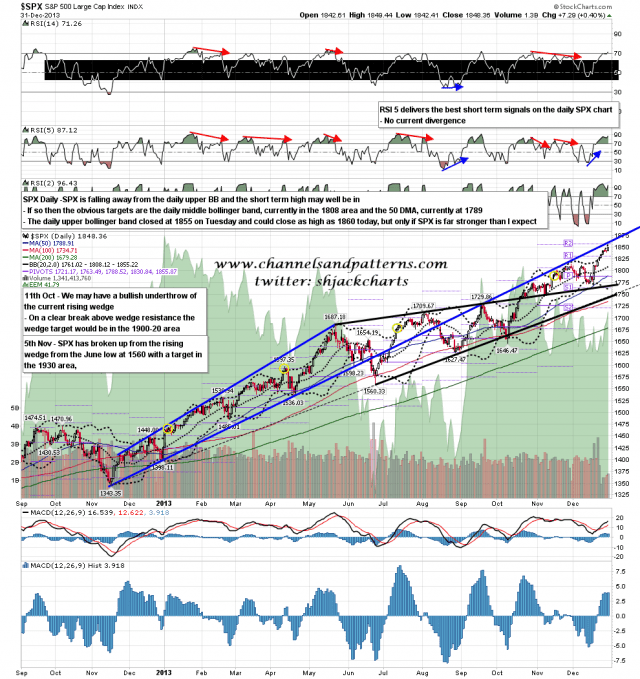

The obvious support levels on the daily chart for any retracement here are at the daily middle bollinger band, currently in the 1808 area, and the 50 DMA, currently in the 1789 area. The 50 DMA target is currently a better fit with a hit of trendline support. I’m not expecting to see a very strong day on SPX today but if we should see one anyway then the daily upper band closed on Tuesday at 1855 and could close today as high as 1860. SPX daily chart:

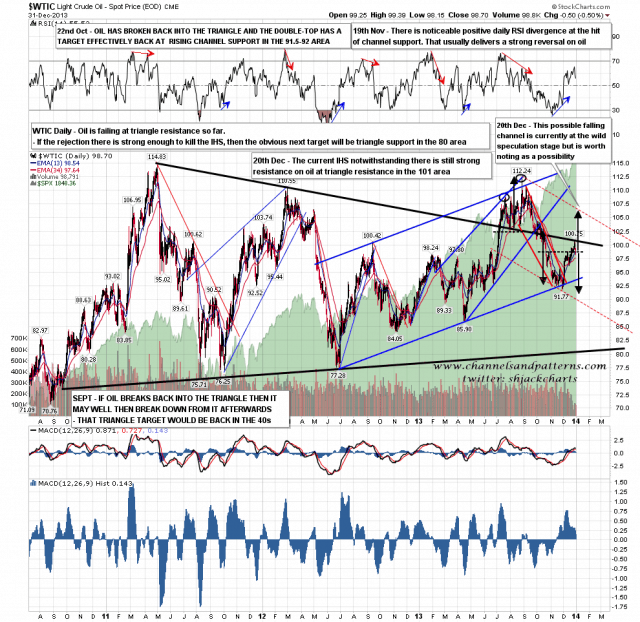

On 20th December I gave a target for the IHS on CL/WTIC in the 106.5 area but mentioned that there was decent resistance at triangle resistance in the 101 area. WTIC reached 100.75 before reversing hard at that resistance and is now back below the IHS neckline. If CL/WTIC gets back below 95 then the IHS will have failed and the next obvious target would be triangle support in the 80 area. I would add that the 100.75 high was an almost perfect 61.8% fib retracement of the last move down so CL may well now resolve downwards. WTIC daily:

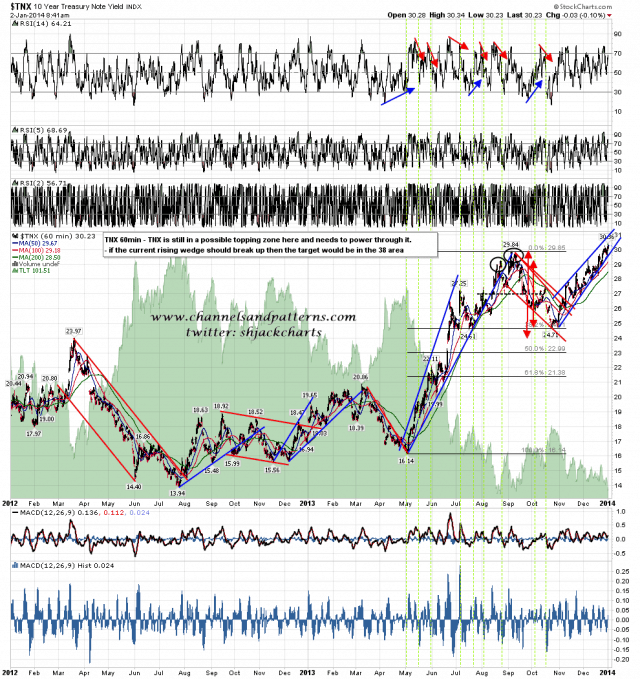

At the last FOMC meeting Bernanke was repeating the oft quoted and almost universally accepted line that a primary purpose of QE is to lower interest rates. I’m amazed that this view is still accepted almost everywhere despite being entirely at odds with the price action on bonds in all three QE periods so far, but am reminded of a comment my father made about a letter sent to him many years ago that either the writer must be a fool, or must be assuming that my father was a fool. Bernanke must know the truth, so it seems fair to assume that he was treating his audience as fools, and from the still credulous reaction, rightly so. Be that as it may my own view is that a token 10% taper seems unlikely to relive the strong upward pressure on interest rates from QE and so far TNX is still moving up. It is still in a possible topping area however and needs to break with confidence over 31 to open up a rising wedge target in the 38 area. TNX 60min chart:

I’m expecting a short term high to be made shortly on SPX and that high may already be in. My retracement target is in the 1800-10 area in a week or two at rising support from the October low.