My broadband connection is back up but hasn’t been back up for long so just a two chart post this morning.

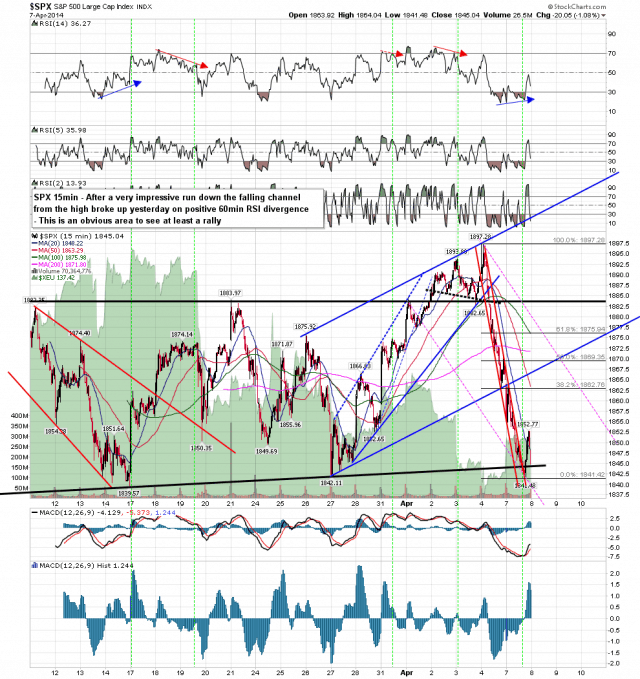

SPX fell again to hit major support in the 1840 area yesterday. The very narrow and steep falling channel from the high broke up on positive 15min RSI divergence, and this is a very natural area to see a rally. What I would add there though is that a channel that looks like this one is very rarely a complete move. I am expecting a rally and then a further decline of whatever size to start from the top of that rally. SPX 15min chart:

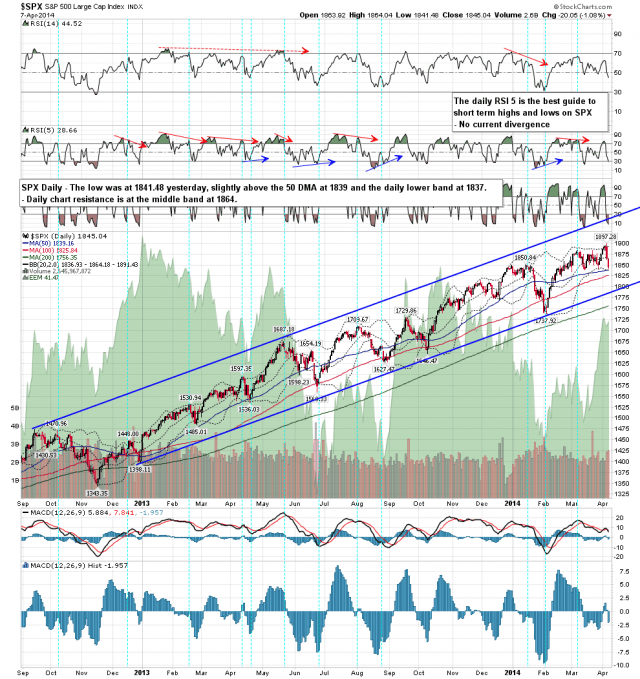

Where might that rally go? Well if we see that rally then I’m looking at the 38.2% fib retracement at 1863 as my primary target and the 50% fib retracement at 1869 as my secondary target. Either is a decent fit with the obvious daily chart target at the daily middle bollinger band, currently at 1864. The bears are in control until we see a break back over that middle band. SPX daily chart:

I need to run a load of charts today to catch up but my first impressions are that yesterday’s weak action after Friday’s trend day down was a major sign of weakness, and that the spring high may well therefore now have been made. For the current move I would expect a rally to start soon before another move down that will at minimum test hard the multiple serious support levels between 1830 and 1840 SPX. On a break down through that range that move down could run a long way further.