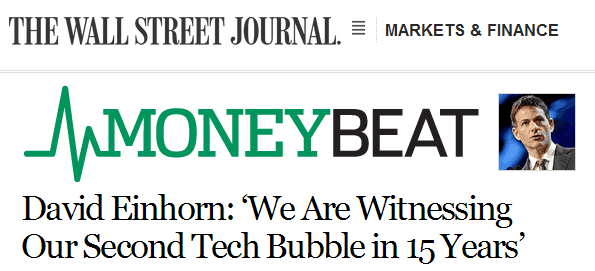

No less a publication than the Wall Street Journal has this as their most-read story (on the same day the Dow Jones Composite made a new lifetime high, never-before-seen-in-the-universe closing value):

Here’s a morsel:

We have repeatedly noted that it is dangerous to short stocks that have disconnected from traditional valuation methods. After all, twice a silly price is not twice as silly; it’s still just silly. This understanding limited our enthusiasm for shorting the handful of momentum stocks that dominated the headlines last year. Now there is a clear consensus that we are witnessing our second tech bubble in 15 years. What is uncertain is how much further the bubble can expand, and what might pop it.

In our view the current bubble is an echo of the previous tech bubble, but with fewer large capitalization stocks and much less public enthusiasm.

Some indications that we are pretty far along include:

+ The rejection of conventional valuation methods;

+ Short-sellers forced to cover due to intolerable mark-to-market losses; and

+ Huge first day IPO pops for companies that have done little more than use the right buzzwords and attract the right venture capital.