The data feed at Stockcharts.com went down on Monday night and is still down, though they did manage to update with some daily data yesterday night. For the moment all of my shorter term charts are down, and the irritation I felt on Monday when the AAPL split deleted every trendline on my saved AAPL charts is now just a distant memory of better times.

I’ll be looking at alternatives for my shorter term charts today, mainly in case this outage at Stockcharts becomes a regular thing, but in the interim this is going to be a shorter and narrower post than usual.

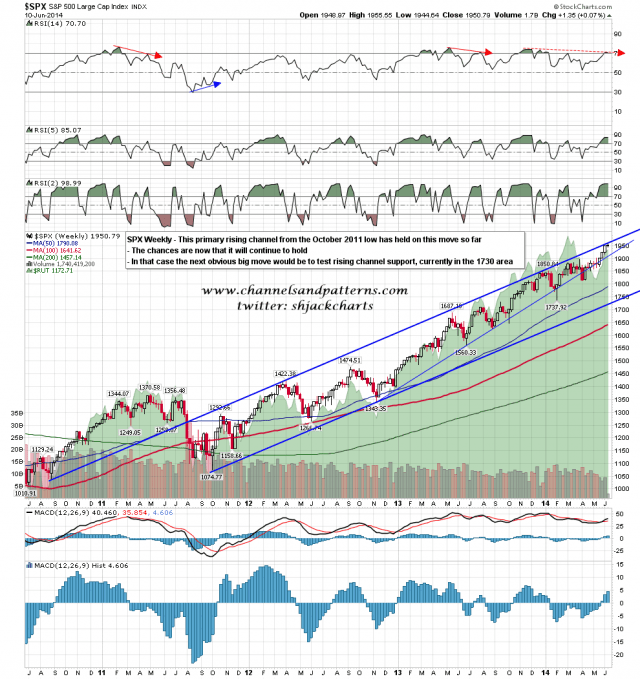

First the weekly chart with my rising channel from the October 2011 low. I was getting concerned last week that this very strong push up might break it, but it has held well so far, and I’m not expecting it to be broken. The next obvious target is rising channel support, currently in the 1730 area, and I’d note that there is a possible H&S neckline level in the 1737 area. SPX weekly chart:

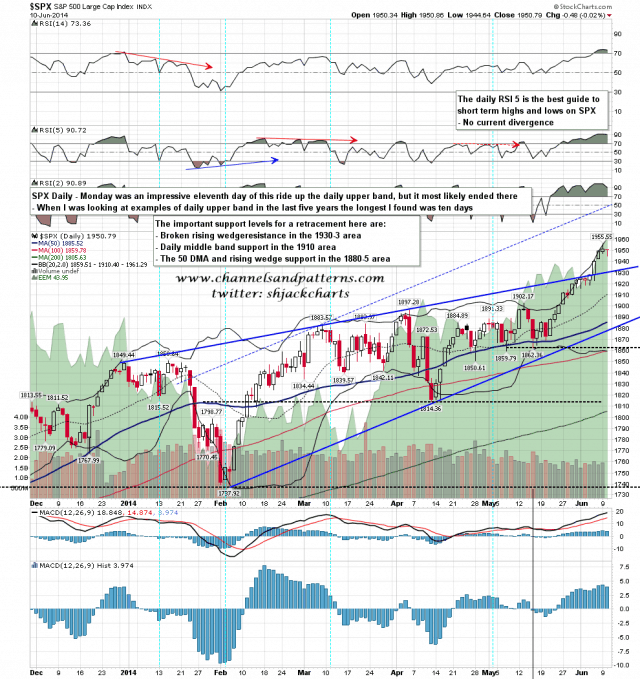

On the daily chart Monday was the eleventh day of the daily upper band ride. Yesterday fell away from the upper band and I’d be very surprised to see that resume today, as eleven days for this upper band ride is already the longest of 27 examples in the last five years. If we see a decent retracement, and this looks a promising start, then the important support levels are first broken rising wedge resistance in the 1930-3 area, then the daily middle band in the 1910 area, then the 50 DMA and rising wedge support in the 1800-5 area. SPX daily chart:

On the ES 60min chart I would note the rising channel from the 1860 low. Channel support was tested overnight and will obviously need to be broken to see more downside. Just below that the weekly pivot at 1937.60 is also important support that needs to be broken. Resistance this morning is at the 50 hour MA in the 1947.5 area, and the overnight high at 1951.75. ES 60min chart:

My take here is that we are in the dying hours of this current move up, or the early hours of the retracement of that move. We may still see a retest of the 1954.75 ES high before a larger retracement begins.