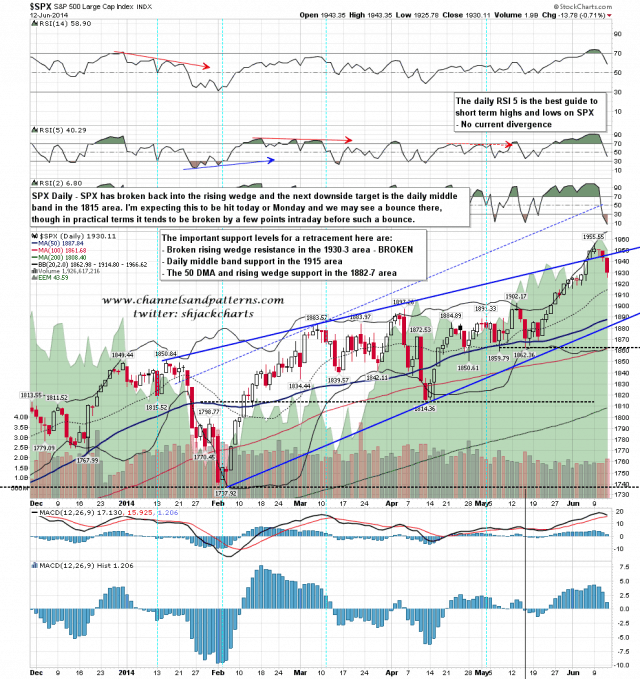

Yesterday finally saw a decent decline on SPX and a considerable amount of technical damage was done. On the daily chart SPX broke back into the rising wedge and the next decent support level is the daily mid band in the 1915 area. SPX daily chart:

On the 60min chart SPX broke below the key 50 hour MA with confidence and should be heading for a test of rising channel support from the 1814 low, currently in the 1900 area. Bears would need to break that to open up the test of the 50 DMA and rising wedge support in the 1883-7 area. SPX 60min chart:

The short term rising wedge on NDX broke down and NDX should now be heading for a test of rising channel support, currently in the 3660 area. NDX 60min chart:

The short term target on RUT is rising megaphone support in the 1143 area. A break below that would give a real boost to the case that RUT has made the right shoulder high on the possible large H&S that has been forming over the last few months. Setup and targets for that are on the chart. RUT 60min chart:

I don’t think there is much danger that this decline has bottomed out, and it may well be just getting started. There is a danger however that the current highs could be retested as part of a topping process, and the resistance levels to watch this morning are the SPX 50 hour MA, currently at 1937.31 SPX, and the ES weekly pivot at 1937.4 ES (June). These are effectively the same level at the moment and while a retest would be fine for the bear case today, a strong break up through 1937 would open up a possible retest of the highs. My personal feeling is that 1937 resistance should hold today and we will make new retracement lows, but if I’m mistaken then be very cautious shorting that resistance break.

As long as 1937 resistance holds, the weather forecast for the bear side looks sunny, and this should be a good day to barbecue some still very complacent bulls. I’ll be posting CL, TNX and AAPL charts on twitter in a few minutes so check there if you need those.