No equity charts today as I covered that pretty thoroughly in my post yesterday. You can see that here if you missed it. Today I’m going to have a look at USD and bonds.

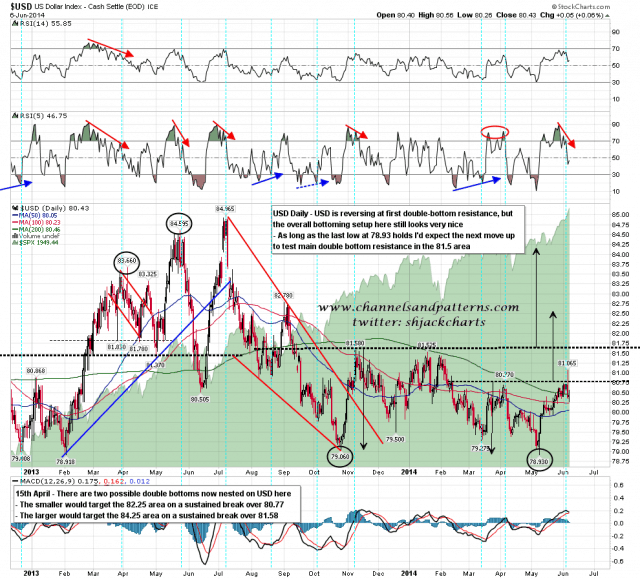

For the last few months I’ve had mixed feelings about USD, as there were, and still are, strong bull and bear scenarios. Last year I gave key support on USD at 78.6 and USD came close to testing that in May. However the marginal new low made in May didn’t challenge 78.6, and I’m increasingly leaning bullish. The daily RSI 5 is signalling a decent retracement here, but as long as the May low at 78.93 holds this retracement should be a buy, and I’d expect the next move up to test main double bottom resistance in the 81.5 area. USD daily chart:

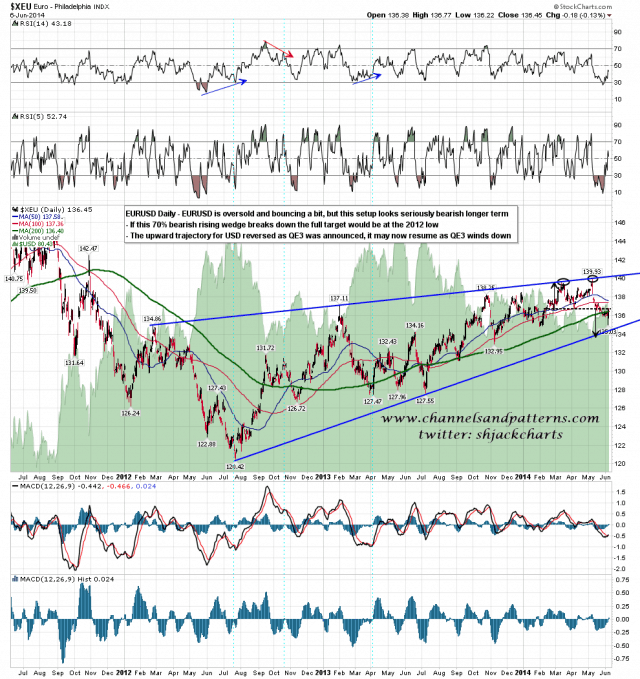

There are mixed signals from the charts for Yen and GBP here, but the largest component of the USD index by far is EURUSD at 57.6%, and the setup there looks solidly bearish. There is a clear 70% bearish rising wedge from the July 2012 low and as long as that doesn’t break up, upside looks limited and the downside target on a break down would be a retest of that July 2012 low.

It’s worth noting here that the EURUSD low was very close to the start of QE3, in effect a massive push to devalue USD, and that as QE3 is winding down this setup on EURUSD looks very bearish. Coincidence? Possibly, but in the absence of QE3 USD may well resume the strong uptrend that was so rudely interrupted by it, in which case a return to the July 2012 low on EURUSD might just be warming up for the next move down for the Euro. We’ll see. EURUSD daily chart:

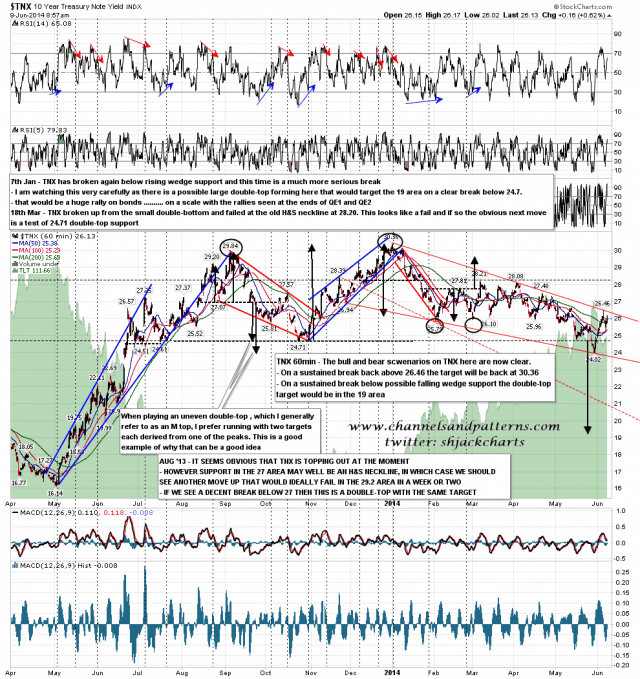

TLT held support where expected a few days ago, but that may not last. Bonds are at a crossroads here, and may go either way. On the bear side there is still a double top targeting the 19 area on a sustained break below 24.70. On the bull side there is now an established 70% bullish falling wedge that would target the 30.36 high on a break up. A strong break either way should be respected. TNX 60min chart:

What will be the impact as QE3 winds down to zero? USD will most likely go up, and may be starting a very big move up that will carry it well beyond the 2012 high. That would most likely mean that oil and precious metals will struggle. Bonds rallied strongly at the ends of QE1 and QE2, but are frankly wildly overpriced already. We should find out which way bonds will break very shortly. As for equities, there were big corrections at the ends of QE1 and QE2. There’s the setup for one of these here too. We’ll see whether that delivers.