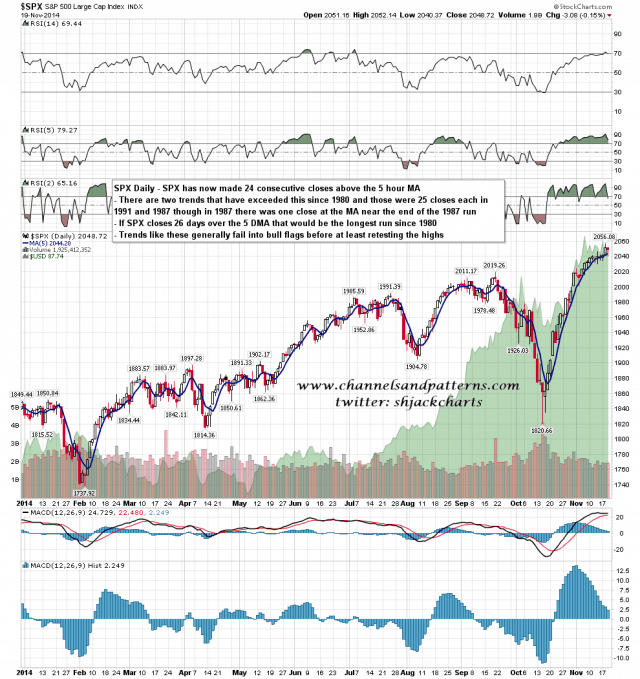

Yesterday was the 24th consecutive close above the 5 day MA. This has only been exceeded by runs of 25 days in 1991 and 1987, though in 1987 one close on the MA might have been a whisker below. If we were to see another daily close above the 5 DMA then that would match the record back to 1980, and possibly for the SPX lifetime, as I’ve only looked back as far as 1980. This has been an amazing run. One thing I would note from the four longest runs since 1980 is that they all failed into modest bull flag retracements before continuing upwards. We may see this break down below the 5 DMA today and if we do, that’s worth bearing in mind. SPX daily 5 DMA chart:

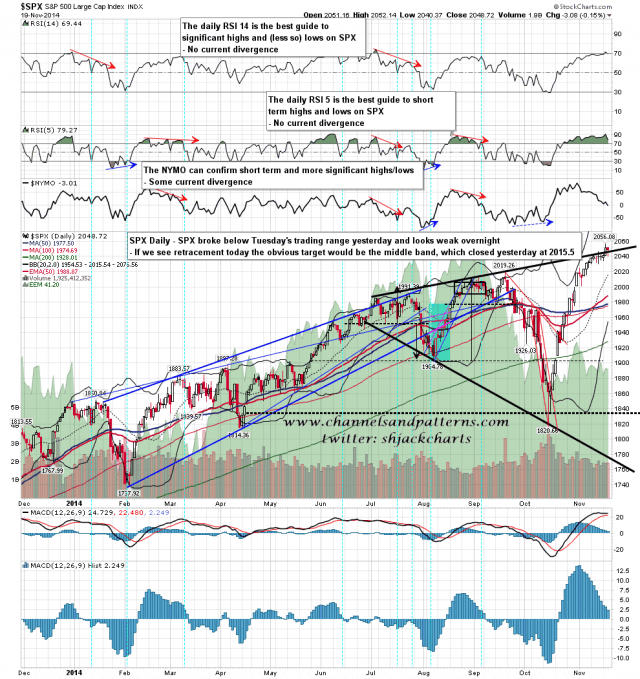

If we do see a retracement today, and the open looks likely to be very weak, then the obvious target would be the daily middle band. That closed yesterday at 2015.5 and is likely to go as high as 2020 today. SPX daily chart:

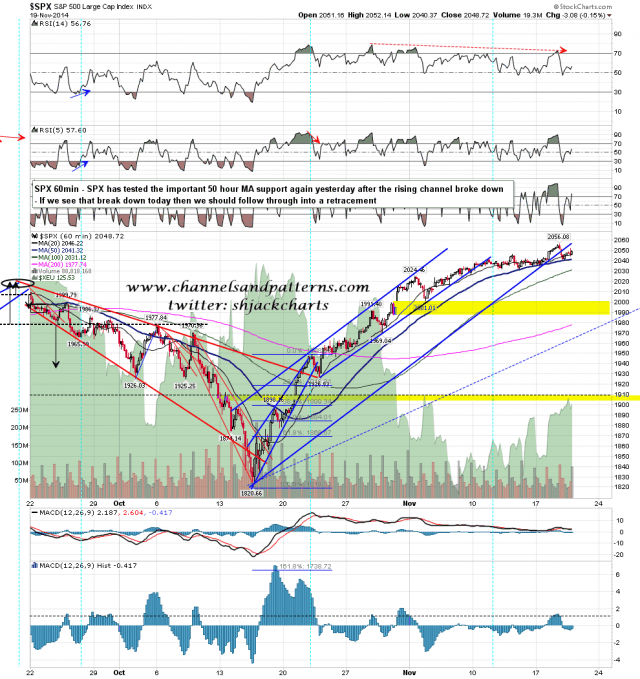

For the first time in a while the range yesterday broke under the range on Tuesday, which was a significant sign of weakness. Main support was the same as it has been for a week at the 50 hour MA. If that should break with any confidence this morning then I’d be looking for follow through in a likely bull flag retracement. SPX 60min chart:

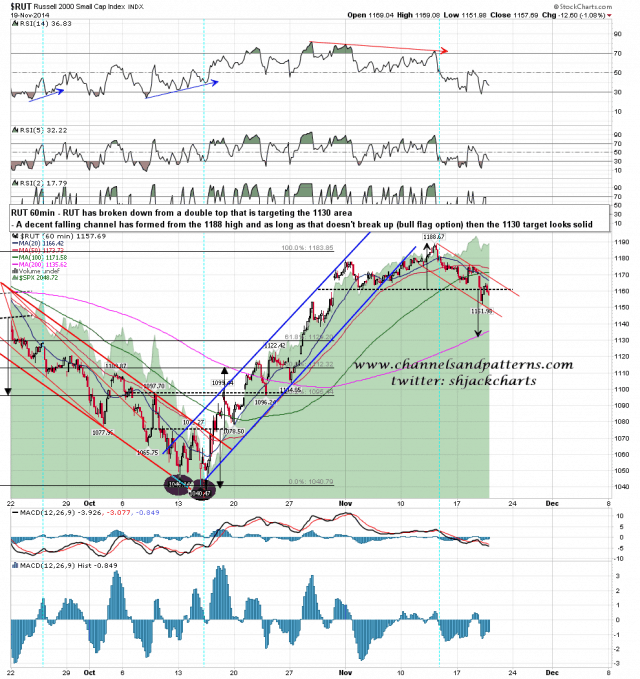

RUT has been leading to the downside here and broke a small double top yesterday with a target in the 1130 area. The overnight action here looks promising to see that target made though I have put a caveat for that on the chart in the event that we see a strong open and RUT outperforms today. RUT 60min chart:

I’m looking for an initial move up today followed by a move down that might develop into a trend down day. The key to seeing decent downside today is a clear break below the SPX 50 hour MA.