Well the doji consolidation stats I posted yesterday gave 75% odds of a small retrace before (most likely) higher, but once again SPX took the lower probability path of the 25% chance of breaking up. It was a clear breakout candle so I have looked at the four of sixteen of these from the start of 2009 that broke up and the following days for these played out as follows:

– Trend up day on day 2 for 1.5% gain. Short term high slightly higher on day 3

– Modest gain on day 2. Short term high on day 4

– Modest gain and short term high on day 2

– Inside day in upper half of breakout candle on day 2. Short term high on day 4

Now this is only a sample size of four, but the lean is clear. These stats are suggesting that yesterday did not make a short term high, and that that a short term high should be made from today through Friday, and could be as much as 2% higher. Three out of the four closed green on day 2, and the fourth close was only slightly below the breakout candle close. The lean coming into today therefore needs to be bullish, though with the expectation that there should be a short term high this week that should then retrace into (75%) or near (25%) the doji consolidation area that SPX just broke up from.

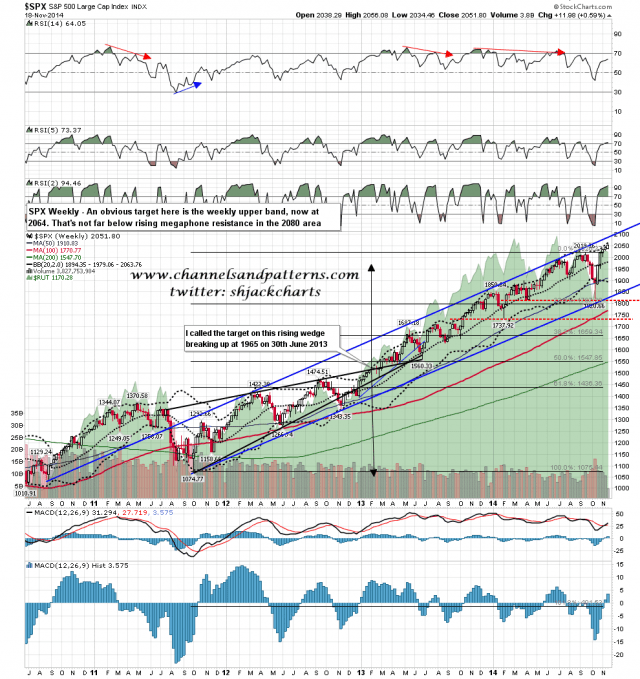

What are the obvious targets above? Well my eye is drawn to the weekly upper band on SPX, which closed yesterday at 2064 and is within easy reach on any move over yesterday’s high at 2056. Next big resistance is primary rising megaphone resistance, which I have in the 2080 area. SPX weekly chart:

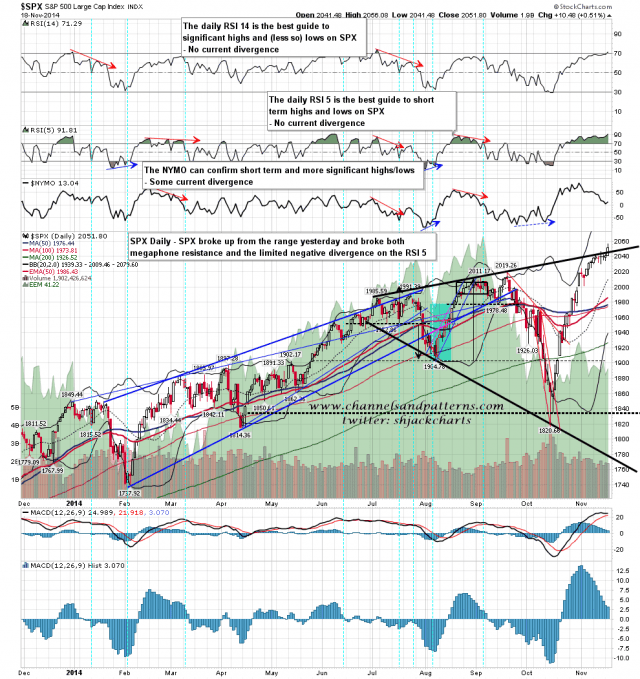

Another possible upside target is the daily upper band at 2080. That’s possible and would be a decent fit with rising megaphone resistance. Any higher on this move is most likely out of range. There was a clear break of the shorter term megaphone resistance trendline yesterday and that should follow through to the upside. I’m not treating this as a particularly significant pattern. SPX daily chart:

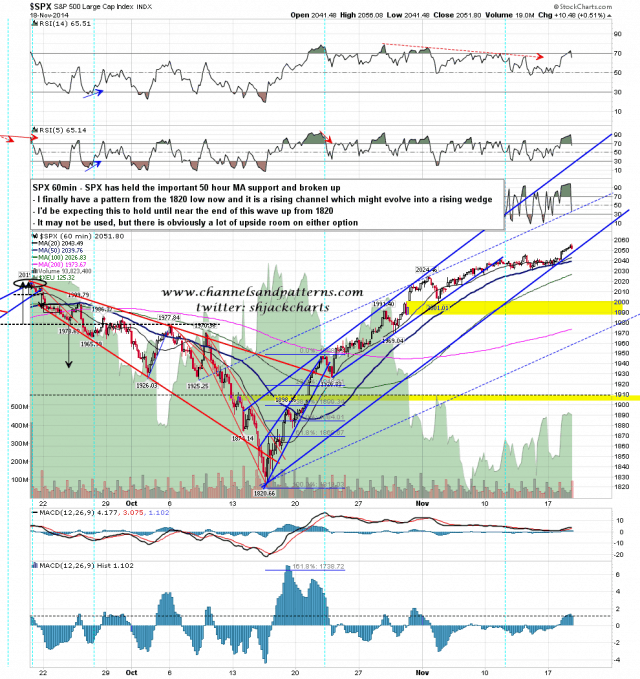

Something interesting that I saw yesterday and posted on twitter was a possible rising channel that has now been established on SPX using a low just before yesterday’s break up. This channel may well not last long, as it is rising at about 9 points per day, and that is really very steep. It is bullish as long as it lasts however and gives a possible target at rising channel turns wedge resistance in the 2090 area. That would be within 2% of yesterday’s close of course, even if it looks very ambitious for this week. SPX 60min:

That was a clear breakout candle yesterday and my stats are firmly leaning bullish on that break. If SPX gets back below 2045 then this might still go the other way but until then I’m expecting yesterday’s high to be taken out today (75%) or tomorrow (25%) and I’ll be looking for a short term high later this week that should then retrace back into the 2030-40 area (75%) or at least a retest of the 2050 level (25%). I’d note that either of those options would break trendline support on my freshly minted rising channel from 1820.