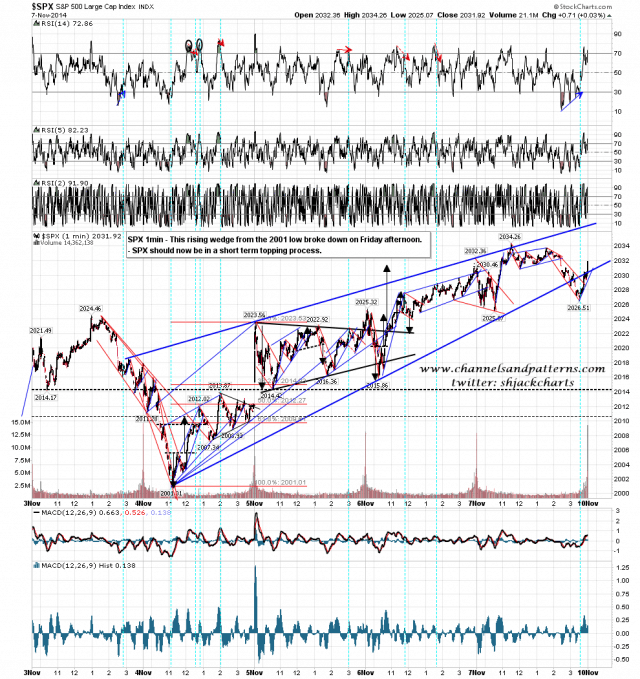

I was looking at two important trendline support levels on Friday morning, and both of them broke down in the afternoon. The pattern from the 2001 low has fixed as a rising wedge and that should now be in a short term topping process. SPX 1min chart:

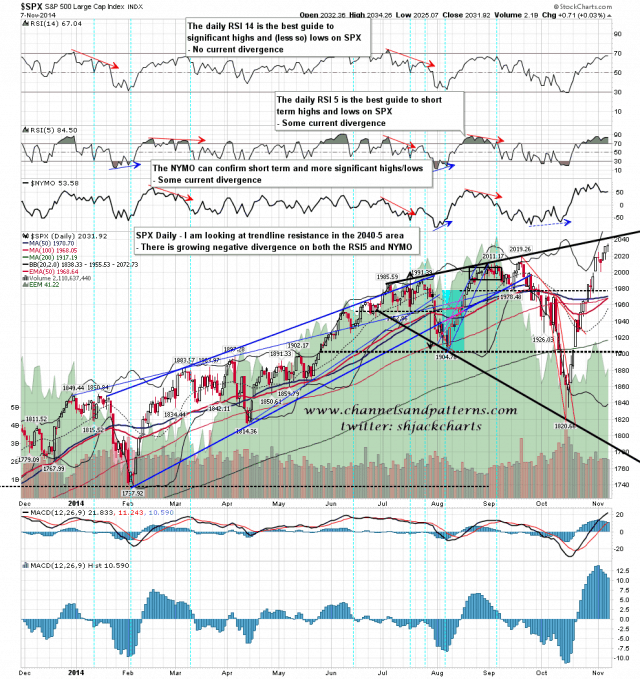

Rising support from the 1926 low also broke down in the afternoon. Once the 20 hour MA breaks I’d be looking for at least a test of the 50 hour MA, currently at 2015. SPX 60min chart:

I still have decent trendline resistance in the 2040-5 area. I’m doubtful about that being reached before a short term retracement, but it’s still just in range I think, so maybe. SPX daily chart:

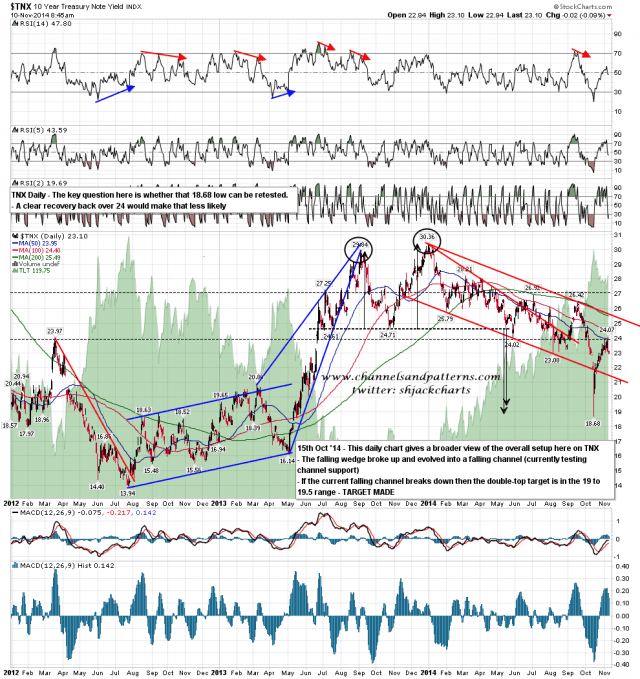

I’ve been wrestling with the bonds charts in recent days for clues as to where bonds may be headed next. On the TNX chart there is still a possibility that the 18.68 low could be retested. A recovery back over 24 would make that much less likely in my view. TNX daily chart:

Ideally I’m looking for a marginal new high today followed by a retracement this week that might just manage to retest 2000. After that I’d be looking for another move up.