That was an impressive decline on Wednesday, and that was a match to the bearish long term stats for the last trading day of the year. The stats today are neutral to very slightly bearish, though it has been a decent performer in recent years, and the gap up today is a promising start for bulls if it can be sustained.

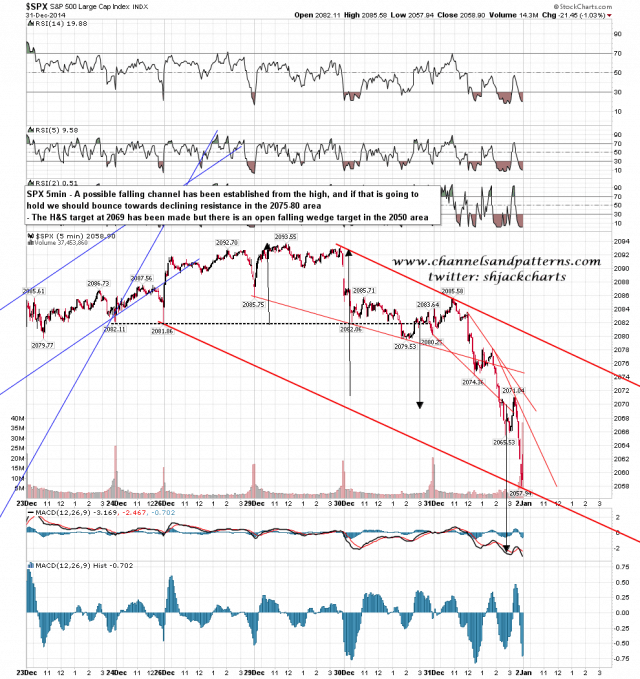

Short term a falling channel was established at the lows on Wednesday and if that holds, then the next obvious move would be a retracement to channel resistance in the 2075-80 area. SPX 5min chart:

If SPX turns back down then it will be worth noting that there is now a clear rising wedge from the October low and that wedge support is currently in the 2010 area. There is decent support not far under Wednesday’s low however, with the daily middle band at 2054, and both the 50 day MA and EMA in the 2035 area. While I’m expecting a move to test wedge support in the next couple of weeks, I’d favor a retest of the highs first to set up a small double top. SPX daily chart:

My lean today is towards a bounce or consolidation. I have caught a nasty cold variant from my daughter & wife so I may well just go back to bed today rather than trade. Volumes are still likely to be depressed today so the day may well in any case not be very interesting. A very Happy (and prosperous) New Year to everyone. 🙂