TO GO LONG

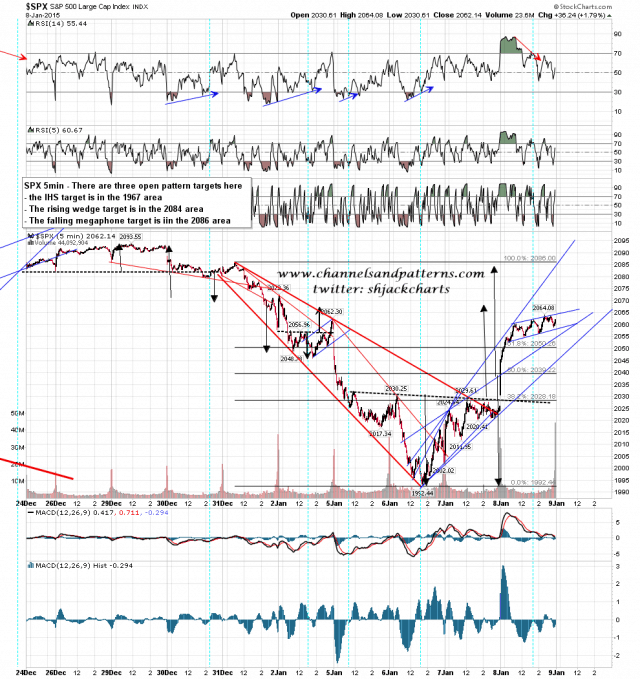

Chart Analysis

The DAILY chart of the ESH15 below helps us visualize the fact that the potential upside for the DAILY impulse is limited if compared to the potential downside. Why? Because our calculation of the impulse extension TO GO SHORT begins from the last candle closing down, i.e. 1994.5 on January 6, 2015, and so a good part of the possible total extension of this upward impulse has been already eaten away by the current wild bounce. On the other hand, the calculation of the TO GO LONG levels starts from the latest up Close, and so there is plenty of room to go down from these highs. For the investor, this means that it would be a bad idea to buy right now, better wait for the inevitable pullback and then, at that point, we can buy at better prices.

CCOC – Consecutive Closes Odds Calculator (TIME EXTENSION ANALYSIS) (more…)