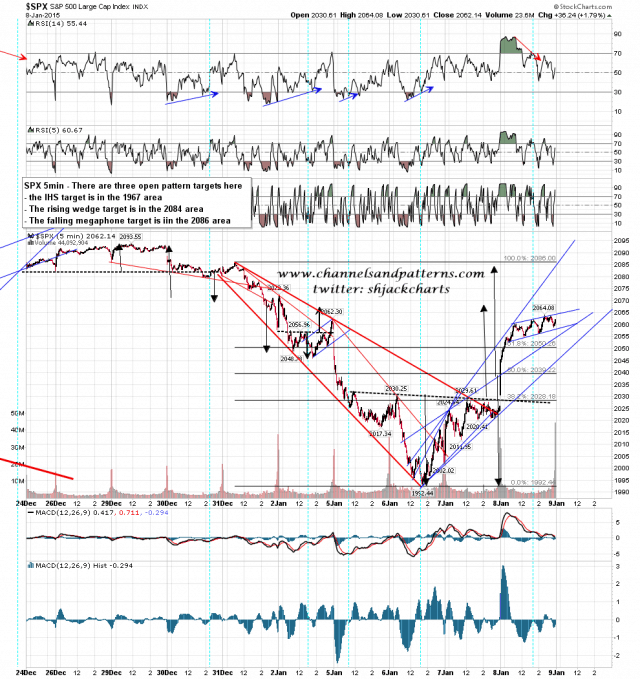

SPX did an impressive breakaway gap up yesterday and almost made it to my IHS target at 2067. I have further targets in the 2084-6 area from the falling megaphone that broke up on Wednesday and the rising wedge from the low. SPX 15min chart:

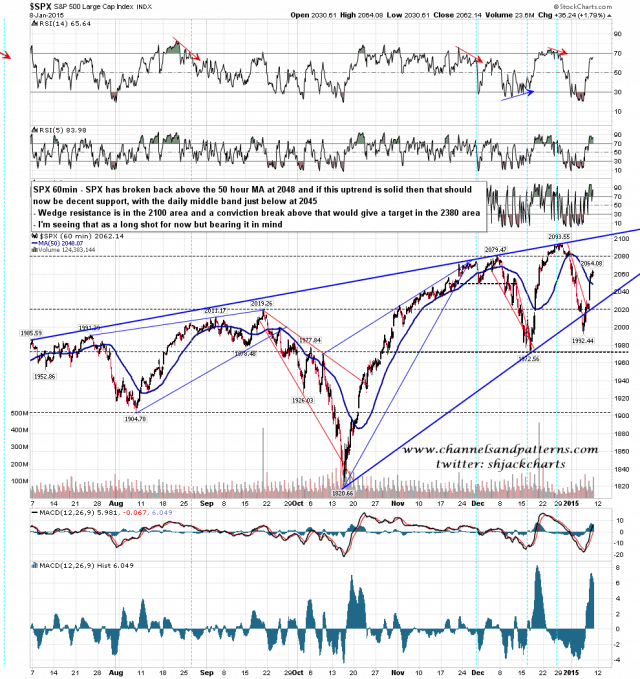

On the 60min chart the obvious next move is to retest the high and if we see a failure there that would set up a double top targeting the 1880-90 area. Depending on the time taken to reach that target that might be a good fit with a hit of rising megaphone support on the main pattern from the 2011 low.

Alternatively what we could see is a break up over rising wedge resistance, now in the 2100 area. If that break was sustained then that would open up a rising wedge target in the 2380 area. I’m very doubtful about seeing that, but I’m bearing the possibility in mind. SPX 60min chart:

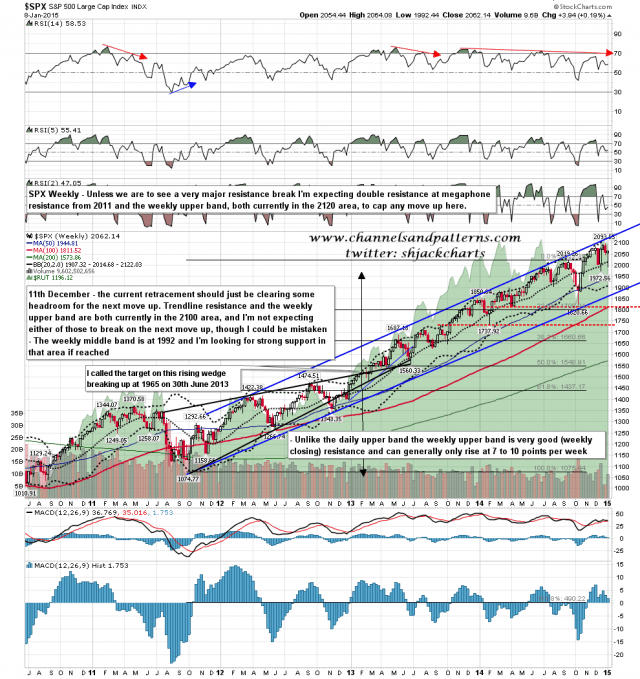

The reason that I’m very doubtful about seeing that break up is that there is very strong resistance in the 2120 area (rising fairly slowly). That is on a rising megaphone that has formed over the last three years during which time SPX has almost doubled. It would be rare to see this kind of longer term pattern break up rather than break down and retrace, and I can’t see any obvious reason why it would. Is it possible that this resistance might break? Anything is possible so yes, but I’ll be assuming it will hold until there is clear evidence to the contrary. SPX weekly chart:

I’m expecting to see the IHS target at 2067 made today, and SPX could make a run at the higher 2084-6 targets. Before we see those higher targets though I’d be wondering about retests of the 50 hour MA, now at 2048, and the daily middle band at 2045. Those should be strong support now.

If this move is destined to just be a retest of the highs or marginal new high then I’ll be looking for a clear rising wedge or megaphone to be established in the next day or two to signal that, and I’m already considering options for those.