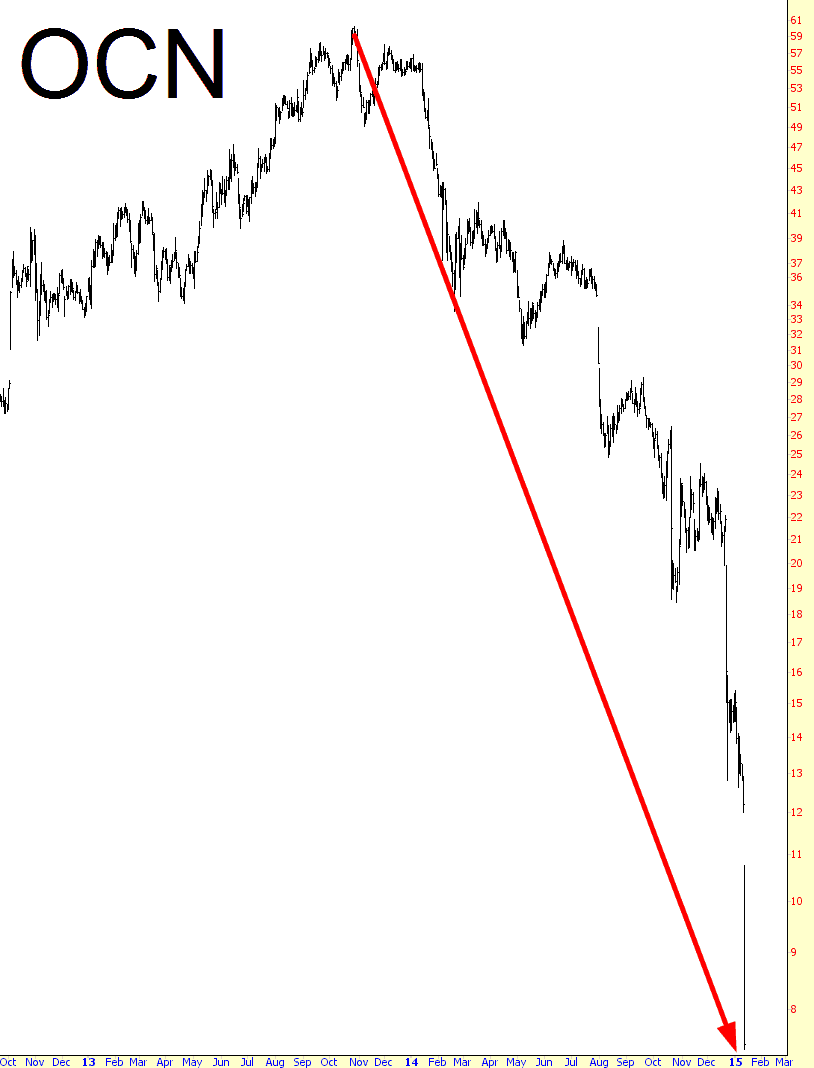

Ugh, this one hurts. I suggested shorting Ocwen Financial as you can see from last June when it was in the mid-30s. It’s a single digit stock now, only seven months later. Hurray for the great recommendation. Boo for not hanging on.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Big Picture Views

With all the hype and noise built in to daily and weekly market management, sometimes it is worthwhile to dial out, calm things down and touch base with markets on the big picture. Here are views on various markets (with limited commentary) by way of some NFTRH monthly charts.

Let’s start with currencies, since they are a reflection upon global policy making, which has been unprecedented in its direct market interference over the last few years.

Nominal Charts – Currency

We noted the hot air patch in the Canada dollar last year. I had thought CDW might stop and find support at 85, which is a measurement from the topping pattern; but so far, no dice.

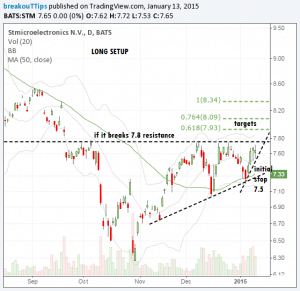

Compelling Breakout Formations

Here is Today’s Watch List of compelling breakout pattern formations: AXLL, BBY, LRCX, STM, SYRG, TK.

Swing Trading Watch-List: ADI PG LVLT SUNE ROC

Inverse Drumbeat for Yield and Gold

A combination of factors — oil & copper prices, sluggish wage growth, weakness in equities today — are pressuring 10-year Yield, which is now at 1.93%, or 10 bps below Friday’s Jobs Report recovery high.

Only a sharp rally above 2.03% will argue technically that Yield has put in a meaningful bottom in and around the 1.90% area.

Conversely, Gold, it is acting extremely well, given the constant headwind of a rising US Dollar (DXY) and otherwise growing deflationary perceptions.

Something is going on in the Gold market that is grinding it higher in an impressive display of relative strength.

My next optimal target zone is $1240-$1244. Key near-term support rests at $1218.00.