On Friday night I posted a quick review of the very bullish setup on SPX at Friday’s close and the full post talking about that was posted yesterday. If you haven’t read that yet you can see that here.

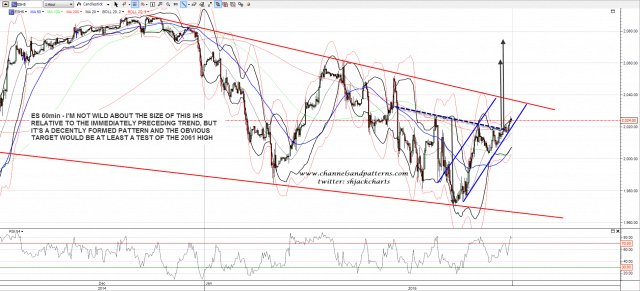

In the short term the possible opening gap over resistance that I was suggesting as likely is looking likely at the time of writing. If that persists into the open then the important thing to remember today is that the bulls most likely own the tape today unless the opening gap fills, in which case we might well see a very strong decline instead, and a new retracement low wouldn’t be unusual. ES 60min chart:

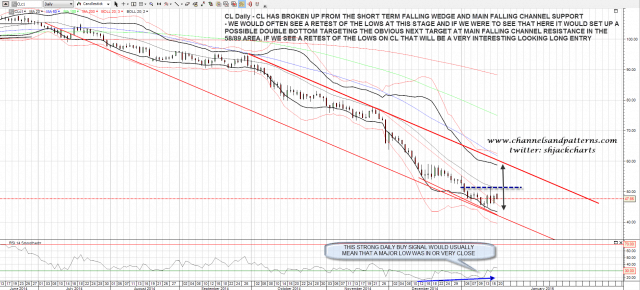

CL has held long term rising support on a weekly close basis, though with a worrying intra-week pinocchio. The setup here looks pretty bullish and the next obvious target is main falling channel resistance in the 58/9 area. We would often see a retest of the lows at this stage and if we were to see that here then that might well set up a double bottom with a target in the right area for a falling channel test. I’d also draw your attention to the big RSI divergence which is suggesting strongly that a big low on oil is close or already made. CL daily chart:

With an opening setup like this the tape today is most likely going to be strongly dominated by one side or the other. With a strong opening gap up the odds will strongly favor the bulls, and if that opening gap fills the odds will favor the bears. I’m leaning bullish today unless the bulls drop the ball and allow the gap to fill. If we see that then the bulls may have a very bad day.