The following Daily chart of the Homebuilders Sector (XHB) shows, that it reached a new 3-year high today (Wednesday), but not a new closing high. However, the RSI, MACD and Stochastics indicators are not yet confirming a move higher. Note the high volume activity since the beginning of this year…signalling major rotation in and out of this sector, perhaps, in readiness for a big move one way or the other.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Morning Musk

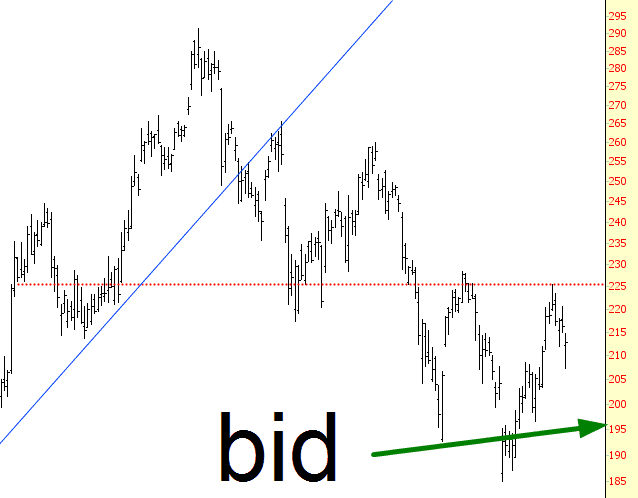

Over the past year, I have done six different posts about shorting Tesla, largely based out of my frustration that they remain a “one product company” whose Model X (on which I am 20,000 who has a deposit) has been endlessly delayed. The company peaked last September, falling from nearly $300 to $212.80 yesterday. Now that earnings are out, and JP Morgan has downgraded the firm, the stop is pre-market down about 7.5%. I’m holding on to this short.

The Long Bond Opportunity

4 Safe Haven Investments to Replace Swissy & Gold

Trying not to pre-judge the title as flat out stupid, let’s proceed to the article…

Four safe-haven investments to replace Swiss francs and gold –MarketWatch

Where to park your money until the next crisis blows over

Greece is on the edge of a dramatic exit from the euro EURUSD, -0.09% . The Russians are meddling in the Ukraine again. The oil price CLH5, -0.46% has been hammered, creating an arc of instability across the Middle East. The global economy is, as is so often the case, poised on the edge of another crisis. If it happens, money will start fleeing to safe havens, somewhere where it can be safely parked to ride out the turmoil.