Absolutely one of the greatest videos ever made, and a long-time favorite of mine: there’s so much to like. I want to be Beck way more than I’ve ever wanted to be John Paulson.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Thank Ya, Crude!

As my Slope+ readers well know, I’ve had a bug up my backside about energy shorts for quite some time. They’ve been doing a yeoman’s job keeping this bear happy in a market that seems to refuse to plunge. It’s interesting that the oil inventory report would come out this morning and cause (appropriately, given its results) crude to accelerate its drop, only to have it rebound firmly. I’ve put an arrow at about the time the report came out. Crude seems to be re-weakening right now, and I’m dedicated to continuing my focus on this “bear market within a bull market”, in spite of a genius like Cramer declaring last week that oil “smelled like a bottom” (which, if you work at CNBC, passes as erudite analysis).

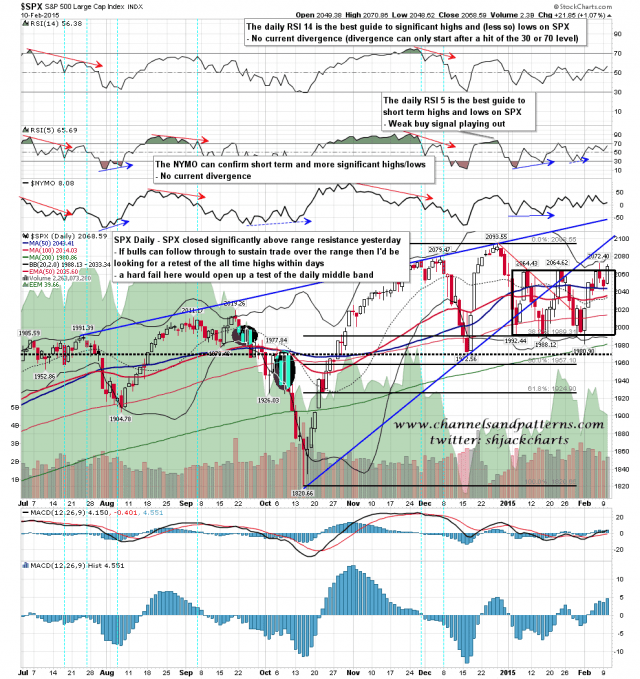

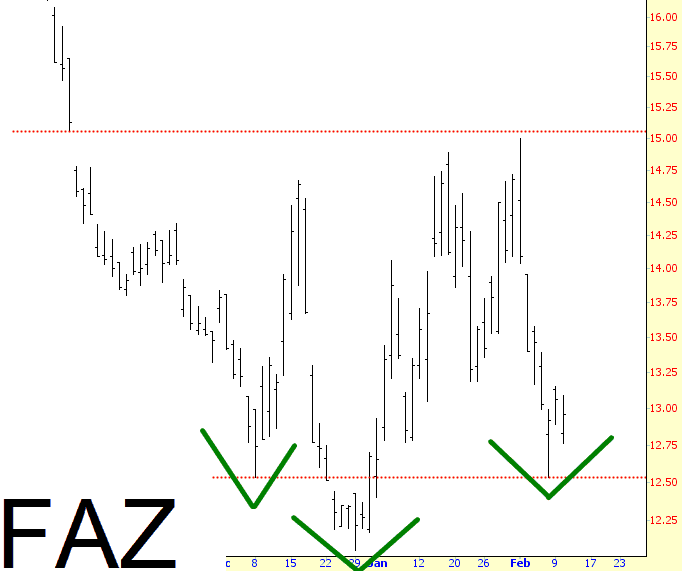

The Three Bears

SPX regularly has runs where patterns repeat and we have a series here at the moment, with a bearish rising wedge from the October low that retraced 38%, into a bearish rising wedge from 1980 that retraced 38%, into a bearish rising wedge from Monday’s low at 2042. Will we see a 38% retrace of that wedge this morning? We shall see. 🙂

On the daily chart yesterday’s close was the first close outside the marked trading range in 2015. If bulls can turn that broken range resistance into support then I would expect to see a test of the all time high within days. SPX daily chart: