The ability of the media to weave together news and the markets has a strange inverted genius to it. If ES has risen strongly on the decent NFP number this morning then the explanation would have been that the market was responding to the increasing strength of the US economy. As ES has fallen instead the explanation will be that the increasing strength of the US economy is making further QE less likely and bringing forward the prospect of increasing interest rates. We should never underestimate the power of a good rationalization:

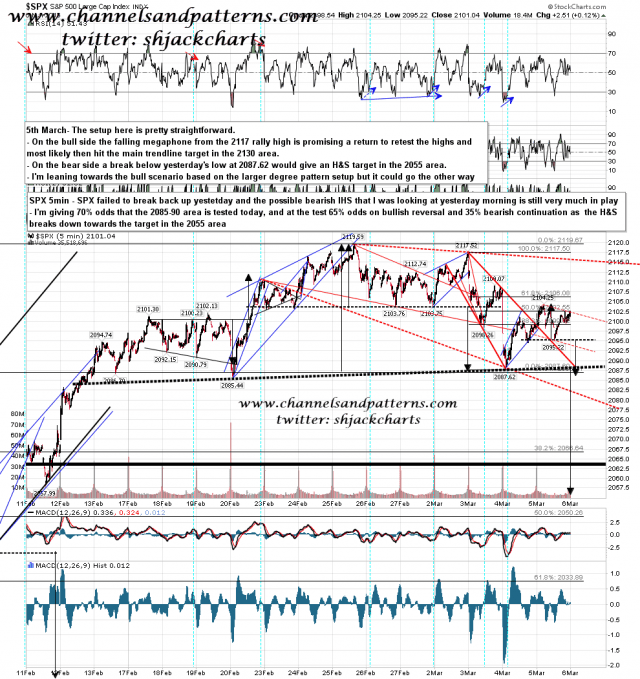

Personally I wonder whether the news was actually important here at all, as a retest of Wednesday’s low was always a strong possibility. The bear scenario requires it to complete and test the H&S targeting the 2055 area on a break below Wednesday’s lows. The bulls need it to set up a double bottom that would target a retest of the all time high on a break over yesterday’s highs. SPX 5min chart:

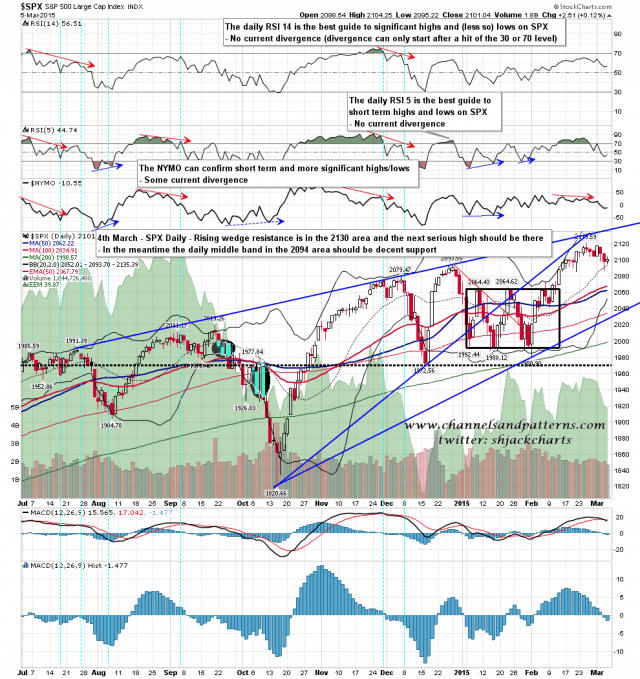

The really key support here today however is the SPX daily middle band. That needs to hold on a closing basis and is starting today in the 2094 area. A decent break of that and the H&S today would target the IHS target at 2055 and the daily lower band at 2052, and I’d expect those targets to then be made. SPX daily chart:

I’m leaning towards the short term bull case into 2130 as long as the daily middle band holds.