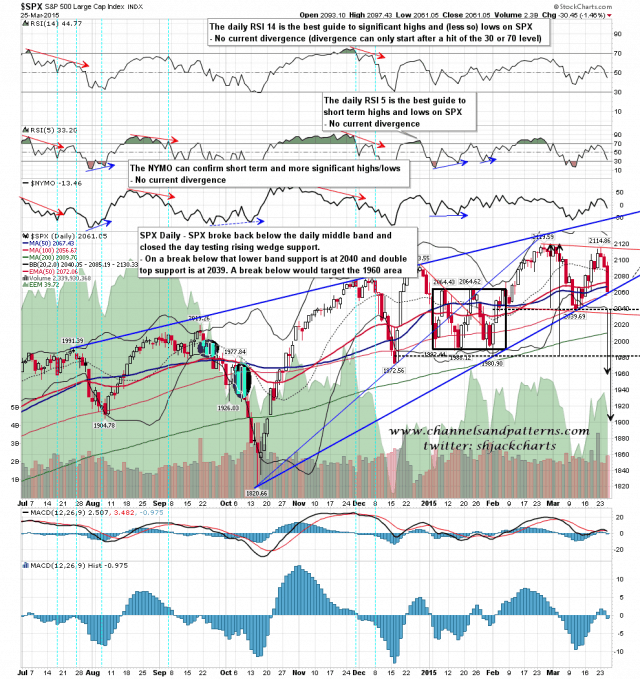

Well I said it would be a big break if my rising channel broke and well, here we are. SPX broke back below the daily middle band yesterday and closed at the test of main rising wedge support. That has broken down at the open and we are back to the stats I gave at the break back below the 5 DMA a few days ago, when I said that every similar break since the start of 2007 had resulted in a lower low before a higher high. I’m expecting that lower low under 2039.69 this week and most likely today. I’d add that the daily lower band is at 2040 so that really is the next obvious target. SPX daily chart:

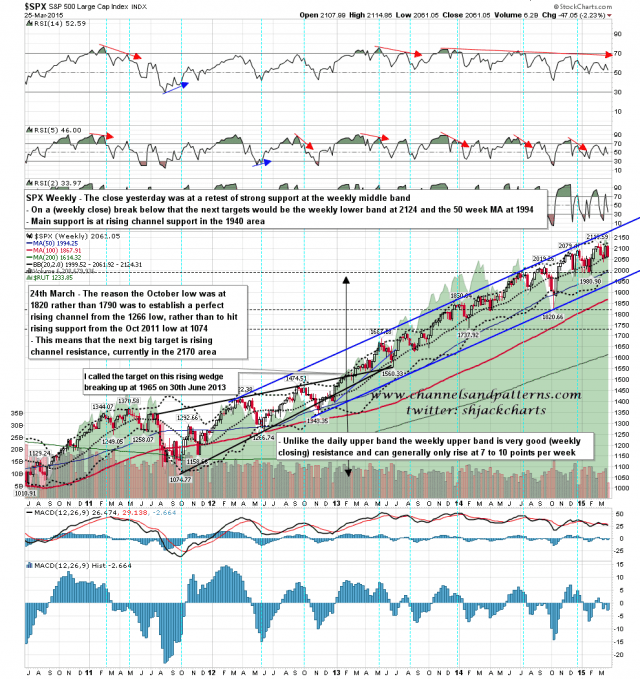

SPX closed yesterday at the test of the very important weekly middle band at 2061. Bulls really want that to hold at the close tomorrow and we have seen some wild rallies in recent months to recover back over that from intraweek moves lower. Whatever happens today that may hold as support at the close tomorrow so that needs to be borne in mind for any shorts here. SPX weekly chart:

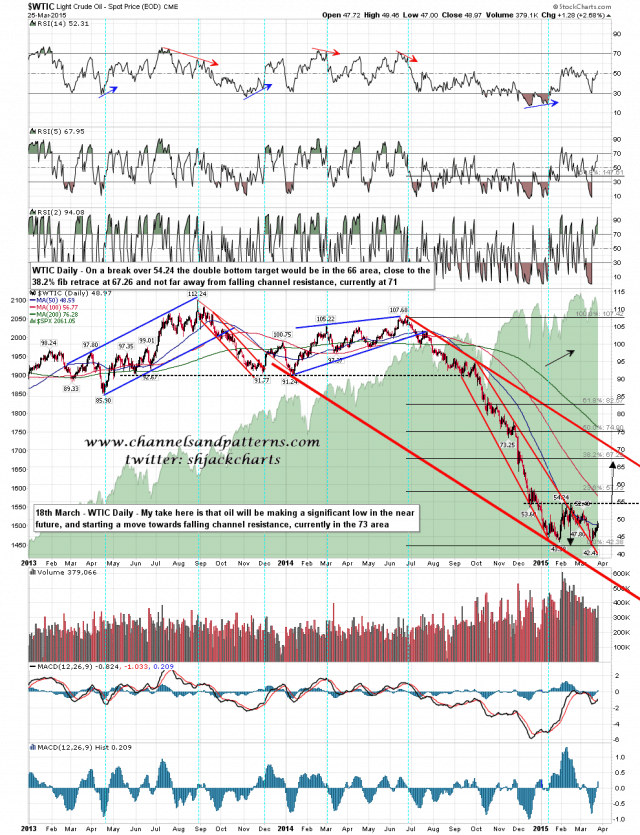

Oil may be breaking back up towards falling channel resistance. On a break over 54.26 the double bottom target would be in the 66 area. WTIC daily chart:

My expectation here at that we are looking at either a double top or a flag forming on SPX. If it is a double top then a break below 2039 would target the 1960 area. If it is a bull flag then the low area would usually be in the 2030-5 area. I am expecting that break below 2039 soon and we’ll see then which of these options SPX will take. Until we see a hard break below the 2030 level I’ll be leaning towards the bull flag option, and if we take that option, then the close tomorrow may well be back over the weekly middle band in the 2061 area. Be alert for a strong reversal shortly after the (very likely) break below 2039.