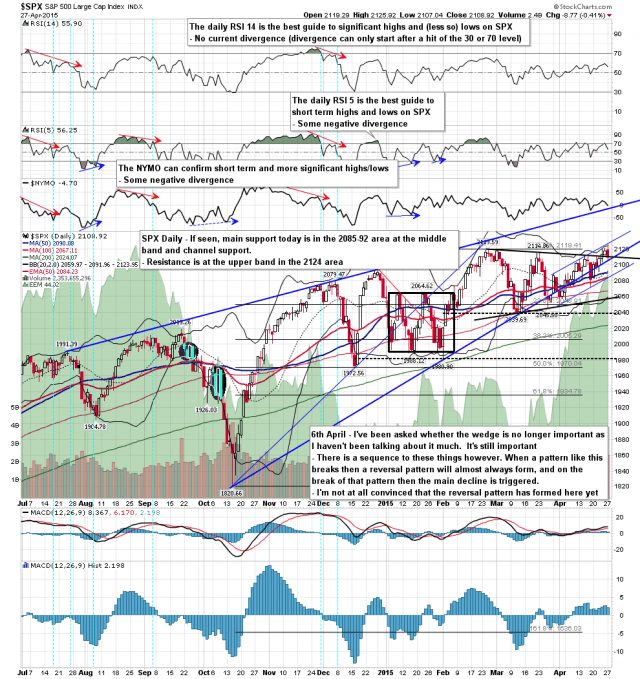

SPX reversed hard in the 2124-8 zone I gave yesterday morning, and we are seeing whether it can reach rising channel support, which should be in the 2085-9 area today depending on the time it would be reached. The daily middle band closed at 2092 last night. There is still some unbroken support at the 50 hour MA at 2104.5. SPX daily chart:

Quite a few readers over the last few weeks have struggled a bit with the idea that the SPX rising wedge has broken down, that I am regarding this as a current and important pattern that should deliver a decent decline, but that I have still been forecasting new highs that have been made.

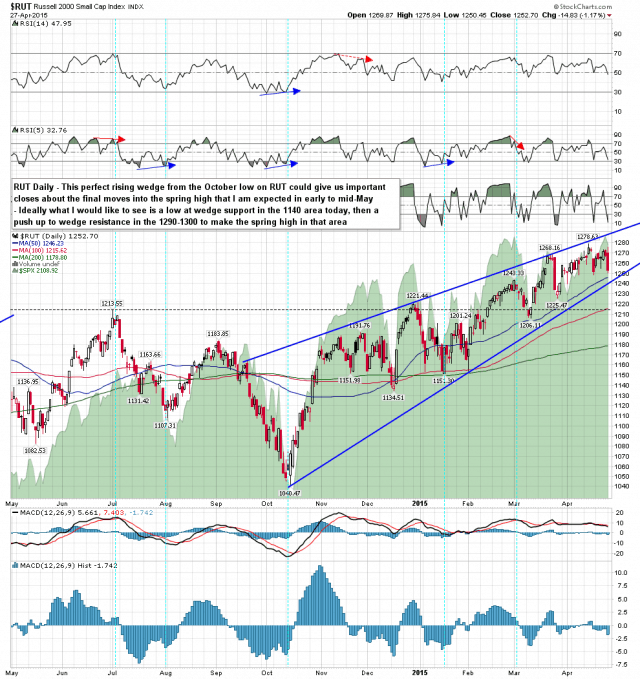

I think a good way to illustrate why this is is to show you the RUT daily chart, with a still unbroken sibling to the rising wedge on SPX. These can often be useful as a kind of distorted reflection to judge where in the topping process a related pattern is, and in this case the RUT wedge is suggesting strongly that SPX is still in the topping process. Targets are also clearer on unbroken wedges and on this RUT pattern I think we might see a move to wedge support in the 1240 area next before a final move to hit wedge resistance in the 1290-1300 area. If seen those hits may give me the approximate start and end of the final move up on SPX as well. I’ll be watching this carefully. RUT daily chart:

I’m expecting to see a lower low today than yesterday but the day may well still close green overall. There’s the Fed tomorrow of course and I’d expect that to keep the market from dropping too hard. If we do see a decent decline today I’l be looking for a low to buy into the final move up to the SPX spring high.