The bulls had a very bad day yesterday and almost managed an even worse night. The reversal candle back through the daily middle band was conceded at the close and overnight ES ran all the way to 2033.50, then recovered back to 2060.75, and is close to that at the time of writing.

Are the bulls dead in the water here? No. Last time I saw an overnight move like this was in early August last year at the 1906 low, and as I recall Mike Vacchi took a long overnight at about 1882. That low was not tested again until October. It is a myth that overnight highs/lows have to be retested shortly after

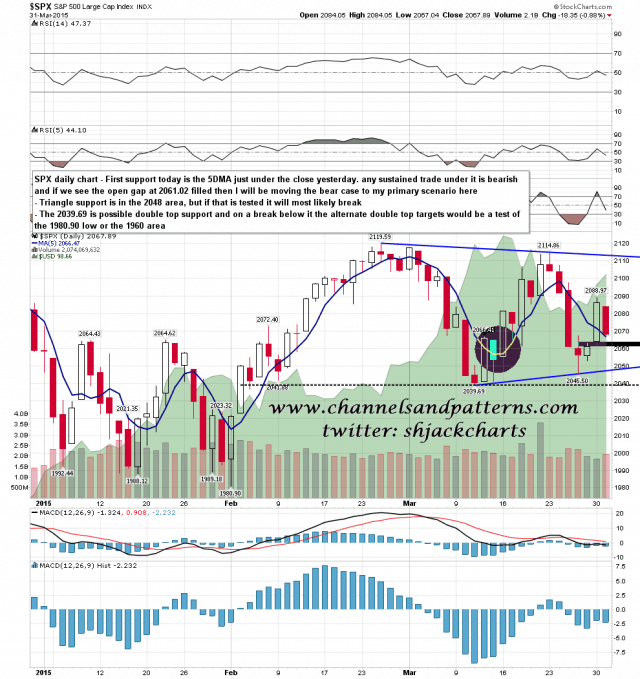

What the bulls need here is to respect the bull/bear line at the 2061.02 gap fill that I gave yesterday morning. As long as that holds my primary scenario is the triangle scenario I gave yesterday morning. if that gap is filled then I’ll move the bear scenario here up to being my primary scenario, though technically the triangle would still be intact until we see a break below triangle support in the 2048 area. The bear scenario is looking for a break below the 2039 low to open up double top targets at 1980 and 1960.

I’ve laid out the options and support levels here on my daily 5DMA chart below. SPX daily 5 DMA chart:

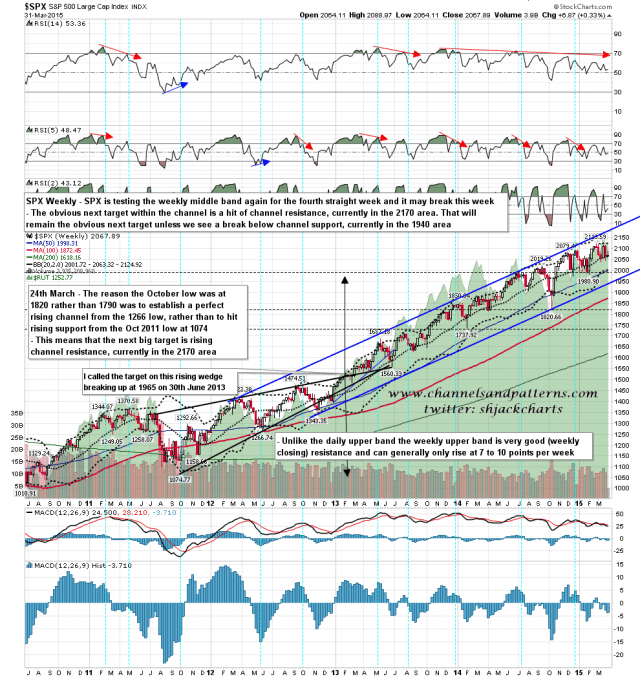

SPX also has decent support at the weekly middle band at 2063.32, though that support is strongest at the weekly close tomorrow night. SPX weekly chart:

As I write that SPX gap at 2061 has just filled so I am leaning bearish. On a break below 2039 we may well see a strong follow through to test the last big low at 1980.90. Main channel support is in the 1940 area. it’s a wild looking market so trade safe.