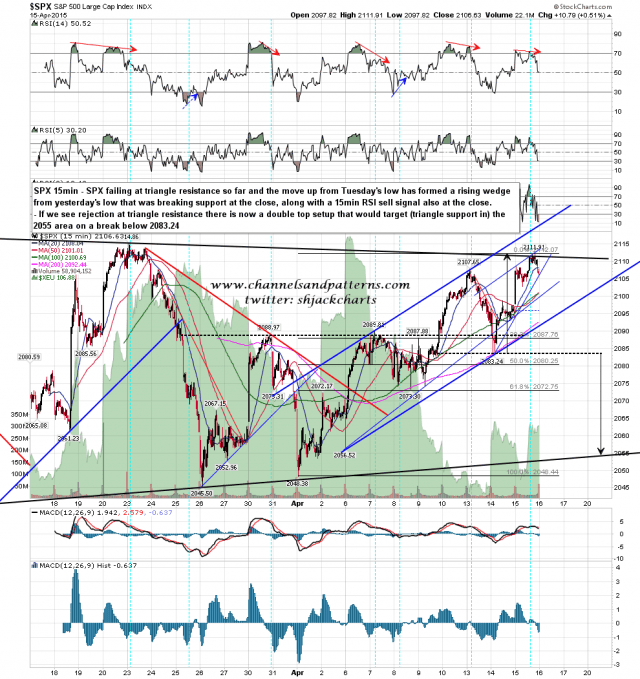

SPX tested triangle resistance yesterday and didn’t break through it. There is a possible setup here for a reversal back into triangle support in the 2055 area and that’s shown on the chart below that I posted on twitter last night. We’ll see how today goes, but if triangle resistance holds again today then we will most likely see at least a test of Tuesday’s low at 2083.24. SPX 15min chart:

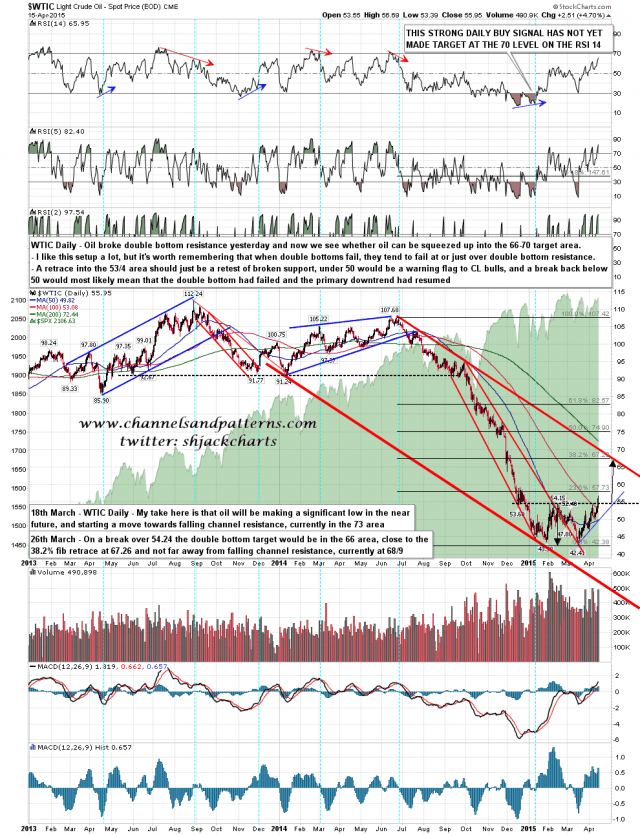

My double bottom setup on oil broke up yesterday. I like this setup a lot and a short squeeze could deliver this quickly, but equally it’s very important to remember that when these setups fail, that tends to happen at or just over double bottom resistance. A break back below 53 now would be a warning flag, and a break back under 50 would most likely resume the primary downtrend. Any longs on oil here are counter-trend on the bigger picture. WTIC daily chart:

Triangle resistance was hit yesterday, and what a long and winding road it has been to get there since I called that target at the end of March. Now that it has been reached SPX is at a major inflection point & we’ll see what happens here. Regardless of the short term I’m leaning bullish overall into at least a full retest of the all time highs unless the 2039.69 low is broken. If that happens then the spring high was most likely made at 2119 & I’ll be looking back to the 1800s or lower for the summer retracement.