SPX set up a small double top yesterday and has fallen hard overnight. It seems obvious that we are now in the final wave E of this triangle, and there is a clear path back to triangle support in the 2050-55 area if bears can manage it. Support and trigger levels are clear so let’s see what happens today.

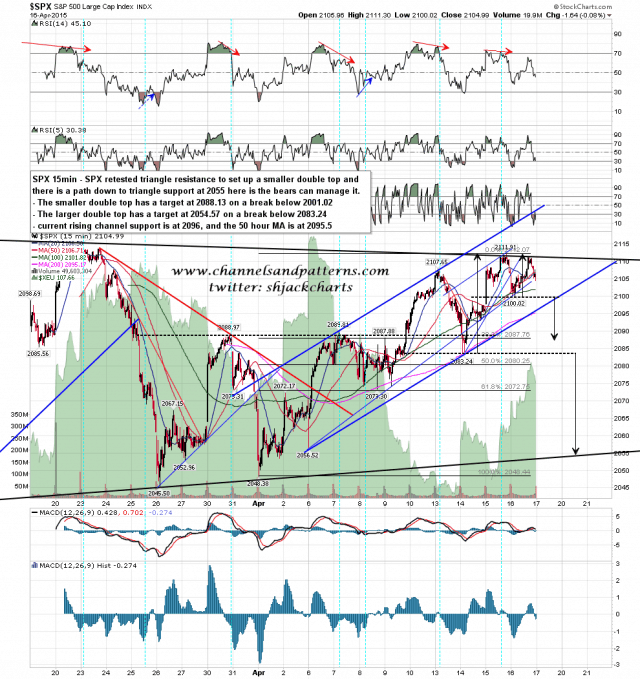

The first level of support is yesterday’s low at 2100, and the break of that at the open targets 2088. That opens up a test of Tuesday’s low at 2083.24, and that is the key level today as it is double top support, targeting 2054.57 on a break below it, and the 50 DMA and daily middle band are also both at 2084. This is a very strong support level and it may hold. SPX 15min chart:

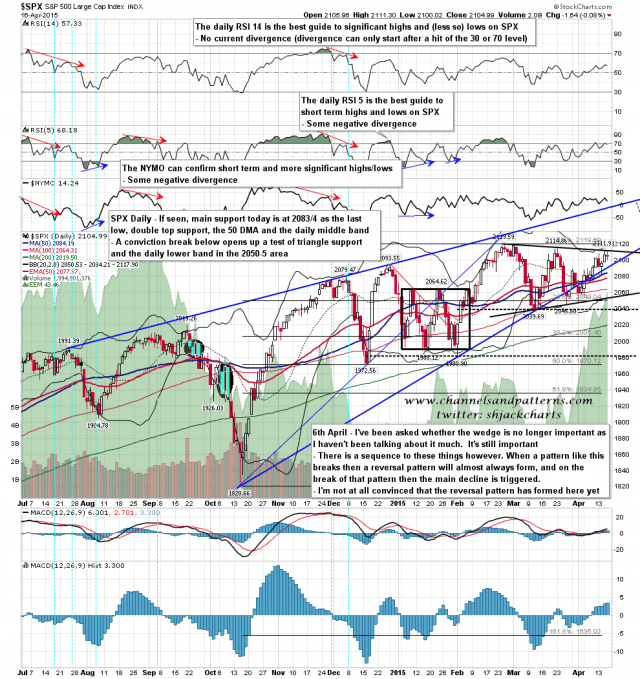

On a sustained break below 2083/4 the double top target is at 2054.57, triangle support is currently in the 2053 area, and the daily lower band is at 2051. Again a clear target at again very strong support. SPX daily chart:

The setup here couldn’t really be much clearer. Let’s see how it goes. There is a very real possibility that SPX will trend down today and the top priority for anyone trading this today should be to avoid becoming counter-trend roadkill. Everyone have a great weekend 🙂