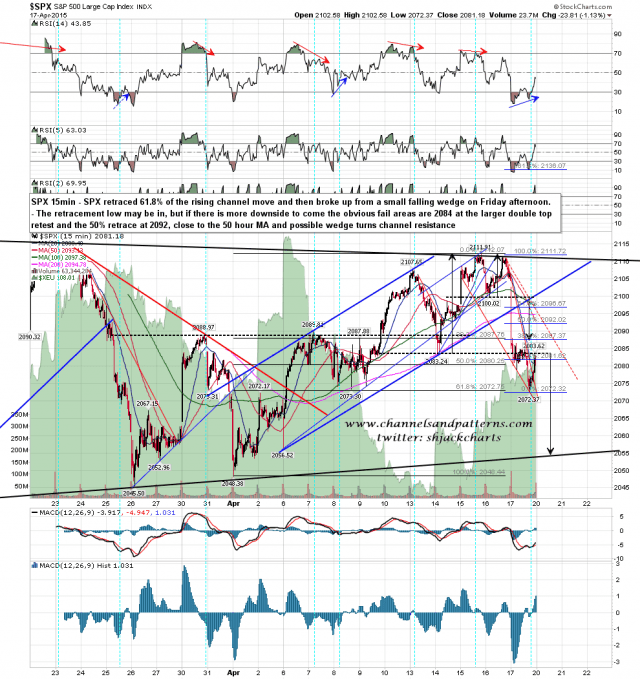

SPX fell hard on Friday, made the smaller double top target and broke down from the larger double top. Shortly after the LOD SPX broke up from a falling wedge that I called on twitter, and closed the day at a retest of broken larger double bottom support. The retracement low may be in, and if we are to see a fail without another test of triangle resistance in the 2011 area then I’ll be looking for resistance at the 50% and 61.8% retracements on the falling wedge, in the 2092 and 2096.5 areas respectively. The 50 hour MA closed Friday at 2096 and is key resistance today. SPX 15min chart:

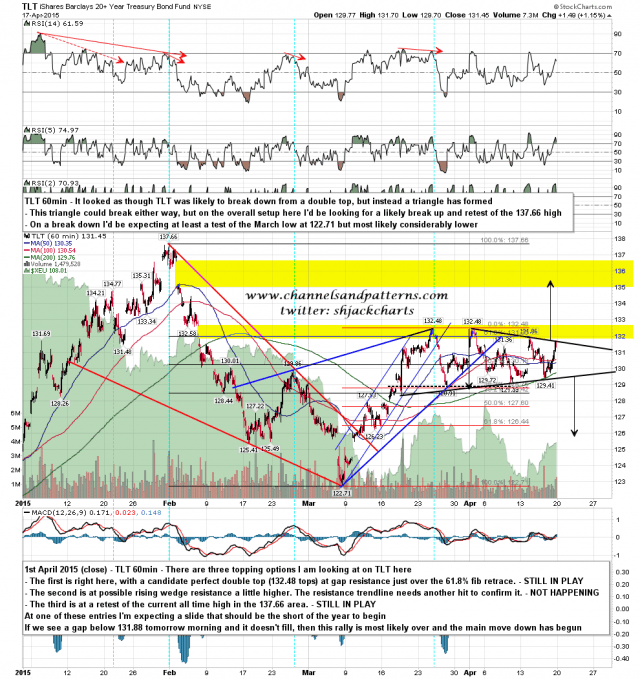

Instead of failing at the obvious double-top setup TLT has formed a triangle and tested triangle resistance late on Friday afternoon. In context, as with the SPX triangle, this is very arguably a bull flag and has at minimum a bullish lean. A break up should deliver a retest of the all time high at 137.66, a break down should take out the March low at 122.71. As ever with triangles there may be multiple false breaks before the triangle makes the genuine break higher or lower. TLT 60min chart:

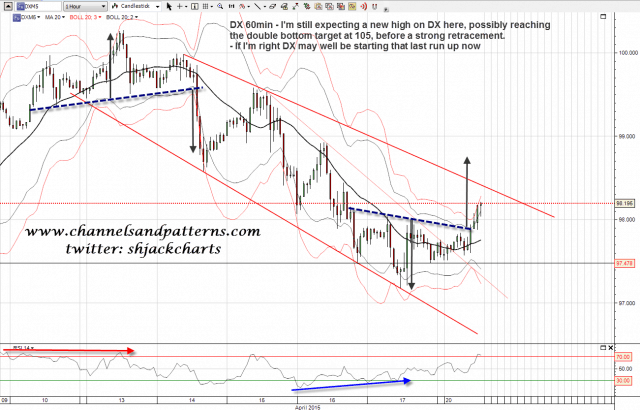

DX is forming a falling megaphone from the last high. An IHS has formed and broken up and if falling megaphone resistance breaks then I’ll be looking for a last run up that may well make the double bottom target at 105, before a big retracement starts that should take DX back into the 90 area. DX 60min chart:

ES opened strong and is already testing obvious resistance at the 50 hour MA and the 61.8% fib retracement of the falling wedge. If we see a break over triangle resistance at 2011 then I’ll be looking for a test of the all time high at 2119.59.