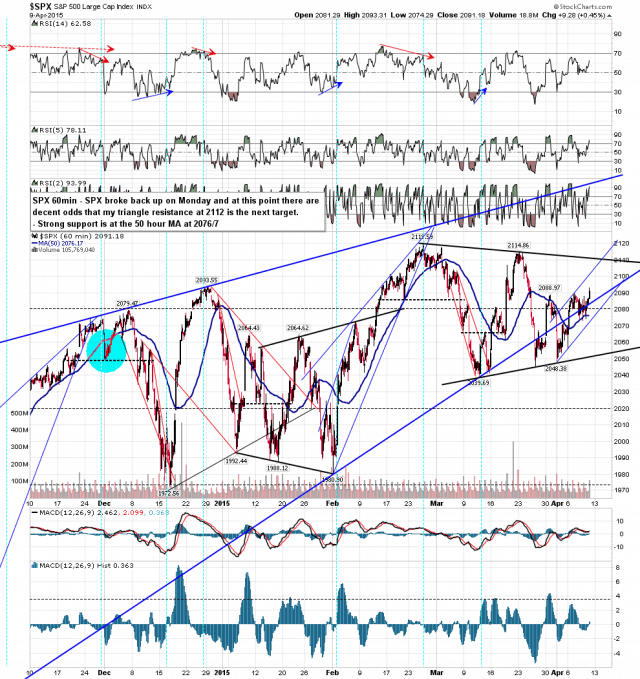

The action has been very whippy this week but the bottom line is that SPX broke back over strong resistance at the 5 DMA, 50 DMA, 50 HMA and the daily middle band, and has very thoroughly and successfully retested those broken resistance levels as support. While that remains the case the obvious targets above are my triangle resistance, still in the 2112 area, and the daily upper band, currently at 2109.54. SPX 60min chart:

I’ve been asked a few times whether I am ignoring the fact that the rising wedge from the October low has broken down. I’m not, but there is a sequence to these things. First the pattern breaks, then a topping pattern forms that will often deliver a higher high as it forms, and then the retracement plays out.

In my view that topping pattern is probably still forming and the triangle is telling us to expect a last thrust up, possibly as high as the (triangle target in) the 2170 area, to make the spring high and then start the very significant retracement that should be starting soon. Anyone not happy to go 80 handles underwater on this trade should be careful shorting until the situation clarifies. Could I be mistaken? For sure. Is there a good chance that I am right? Yes. I’m watching this triangle develop with very great interest.