That was a decent decline yesterday, though ideally bears should have controlled the close and they didn’t. The minimum requirement on all the various sell indicators that I was looking at on Friday and yesterday morning were met as the 15min and 60min sell signals made target, the RSI5/NYMO sell signal made a visual hit just shy of the 30 level at 31.54. That was a very near miss and I’d count that as close enough, so that is effectively made though usually we would see a close under the 30 level and we’ll most likely see one here as well.

In terms of the stats I was looking at on Friday for series of bearish reversal candles the minimum requirement of a 1.65% decline was met yesterday with move of 1.665% from the all time high into yesterday’s low. Of the nine examples that I listed, two reversed back up to retest the high after that decline, of which one continued the previous uptrend, and the other made a marginal new high before a 9.83% decline from that second high. Six continued down without a retest of the high to a median decline of 4.5% to 5% from the high, and an average (mean) decline of 15%. The odds therefore favor continuation down without a retest by three to one. We shall see how far the bulls can rally today.

As for the daily candle yesterday, that was a confident punch down through the daily middle band. he key for the bears today is to close at or below the middle band, and bulls want to reverse yesterday’s candle with a strong close back above it. SPX daily chart:

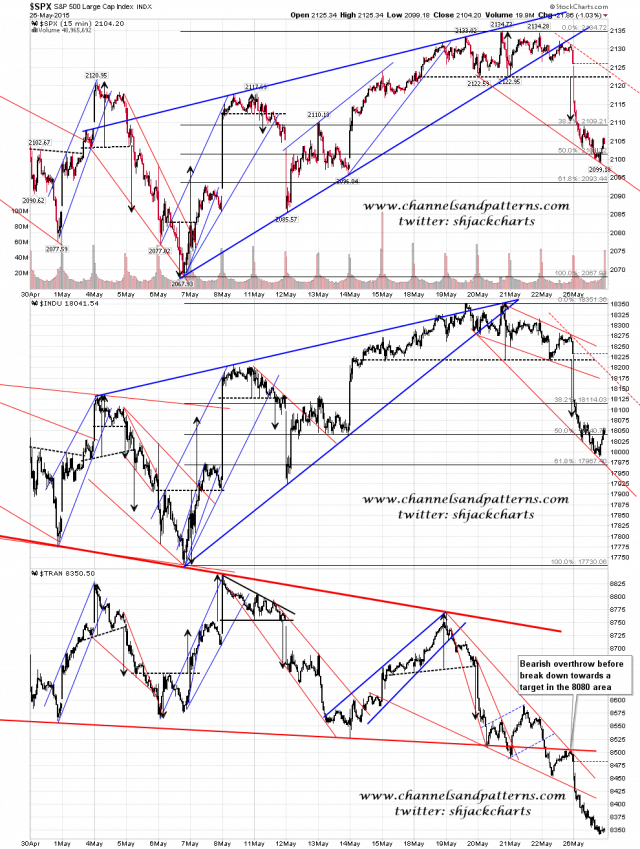

All the short term reversal pattern targets I had marked on my optic run charts yesterday morning made target and I have very decent looking support trendlines on SPX and Dow. The rally today should now establish the declining resistance trendlines. One note of interest on this particular chart is that TRAN did a bearish overthrow of the falling wedge there on Friday and then broke down hard from that falling wedge yesterday. The target is in the 8080 area and I would generally expect that target to be made. That leans towards continuation down after a limited rally here. Scan 3x 15min SPX INDU TRAN charts:

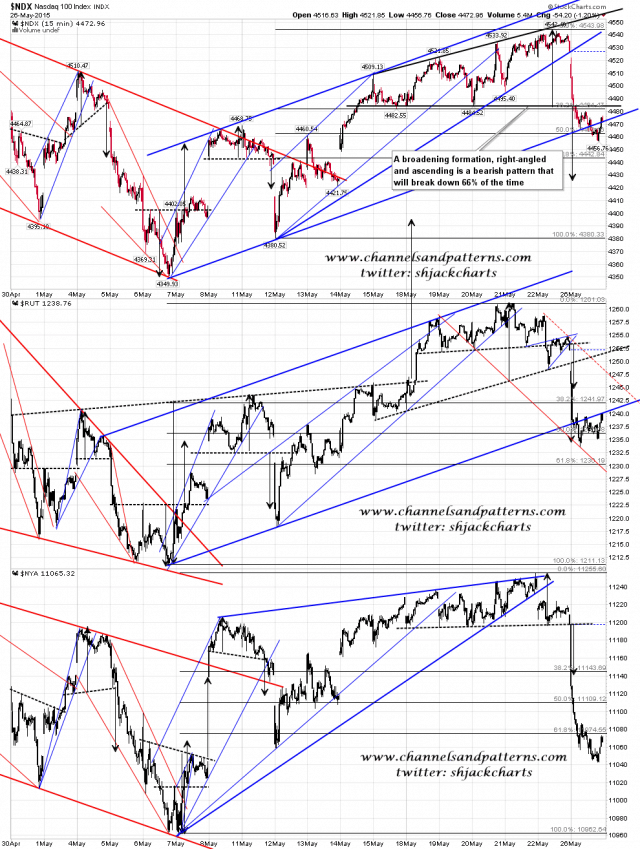

On NDX and RUT I would also note that these were both in clear channels (albeit hard ones to identify early), and those both broke down yesterday. Again this suggests continuation after a limited rally. Scan 3x NDX RUT NYA charts:

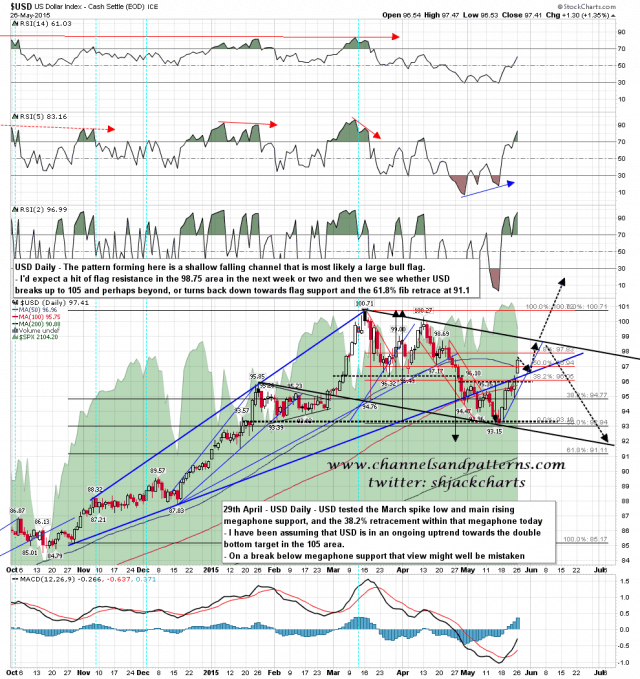

USD has rallied faster than I expected and I have updated the path I am expecting here accordingly. I’m neutral about whether USD breaks up at the test of channel/flag resistance. USD daily chart:

30yr bond yields are following the likely path that I laid out for these last week. We may see yields rally a bit today and if so I’d expect that to be a sell. TYX daily chart:

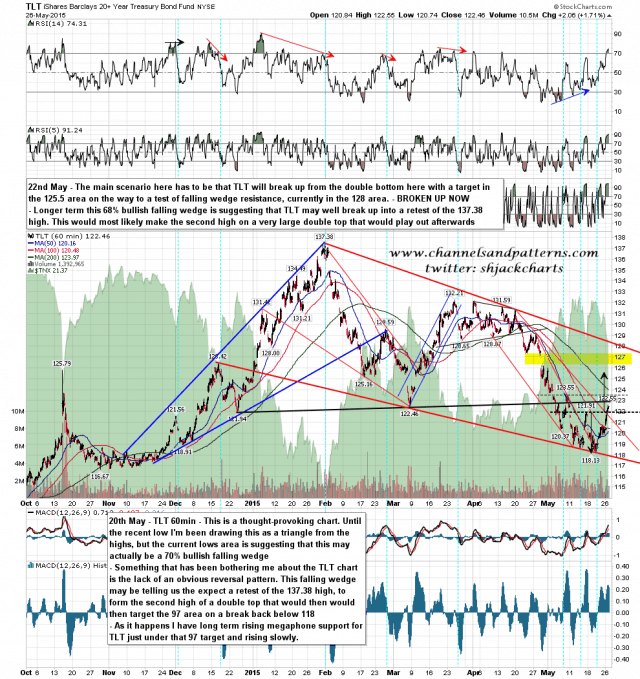

The picture on TLT is mainly just an inversion of the TYX chart. The TYX double top broke down yesterday as the TLT double bottom was breaking up. TLT 60min chart:

SPX is on 5min and 15min buy signals from the low yesterday and we should see a rally of whatever size today. Ideally I’d be looking for that to fail in the 2112.5 area ideal (38.2% fib retrace) and my bull/bear line today is at 2121, with the 61.8% fib retrace level there and the 50 hour MA declining into that area rapidly.