Let’s notice that today’s action in Natural Gas– a new recovery high at 3.105 followed by a vicious downside reversal and decline to 2.954 so far– represents key downside-reversal action, and at the very least, indicates that the upmove from the April 27 low at 2.44 ended today at 3.10.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Bernanke of Warren-Vitter & Last Resorts

By Biiwii

Ref. Warren-Vitter and the lender of last resort

I have always liked Ben Bernanke, in that I think he is a soft-spoken, nice guy who took the hand off from Alan Greenspan in stride, heroically making chicken soup out of the chicken excrement he was left with. He kept his dignity and calm demeanor during the days when inflationist gold bugs codified the term “Helicopter Ben” and turned it into just another accepted way of saying “Ben Bernanke”.

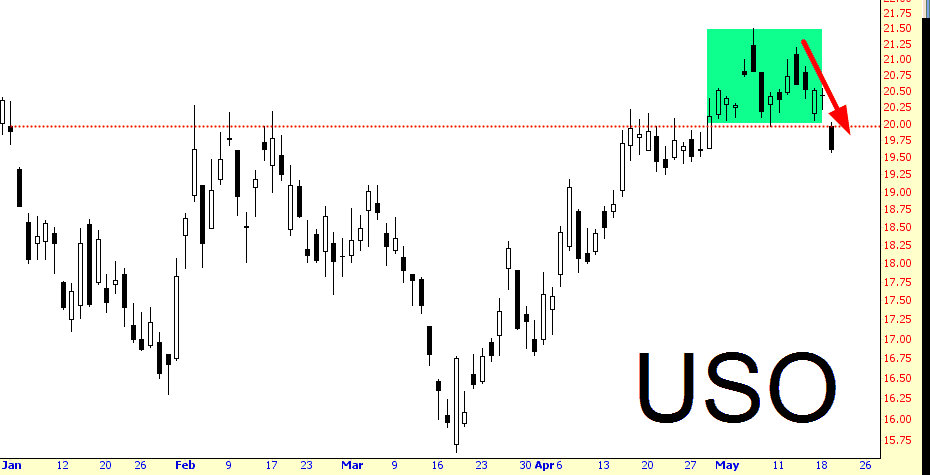

Oil’s Failed Bullish Breakout

Topping Options

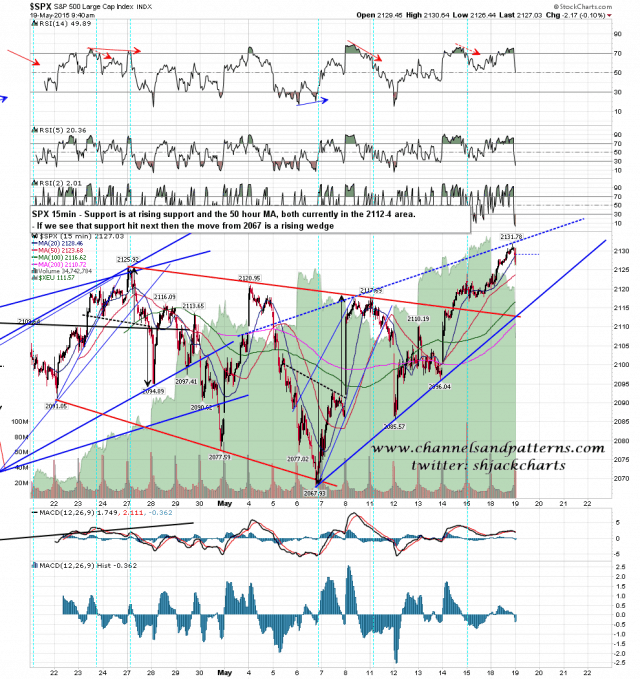

I gave my preferred topping range last week as 2126-35, with a possible overthrow into the weekly upper band at 2145. The weekly upper band is now at 2152. The high yesterday was at 2131.78, well into that preferred topping zone.

Short term the chart looks weak, with a 5min sell signal, a 15min sell signal not yet fixed, and a possible rising wedge resistance trendline hit at the high yesterday. That opens up a possible move to test rising support from 2067 and the 50 hour MA, currently in the 2012-4 area. A break below there should mean mean that the spring high has most likely been made, though it might still then be retested. SPX 15min chart: