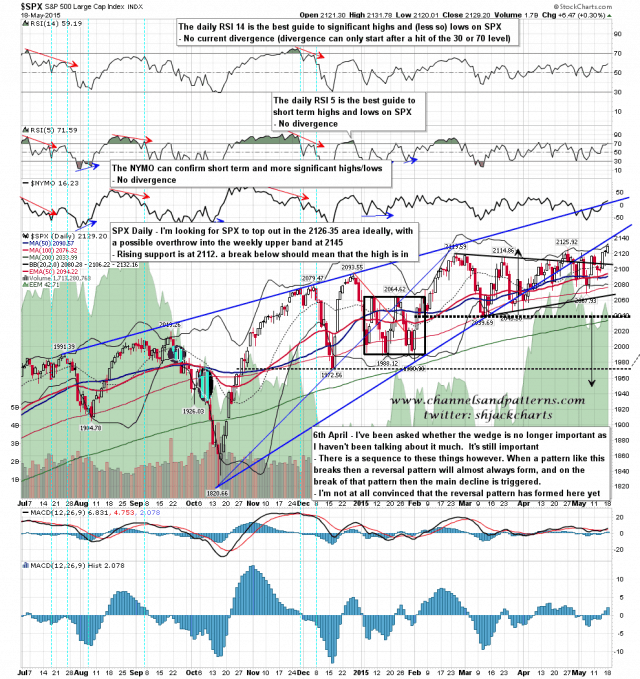

I gave my preferred topping range last week as 2126-35, with a possible overthrow into the weekly upper band at 2145. The weekly upper band is now at 2152. The high yesterday was at 2131.78, well into that preferred topping zone.

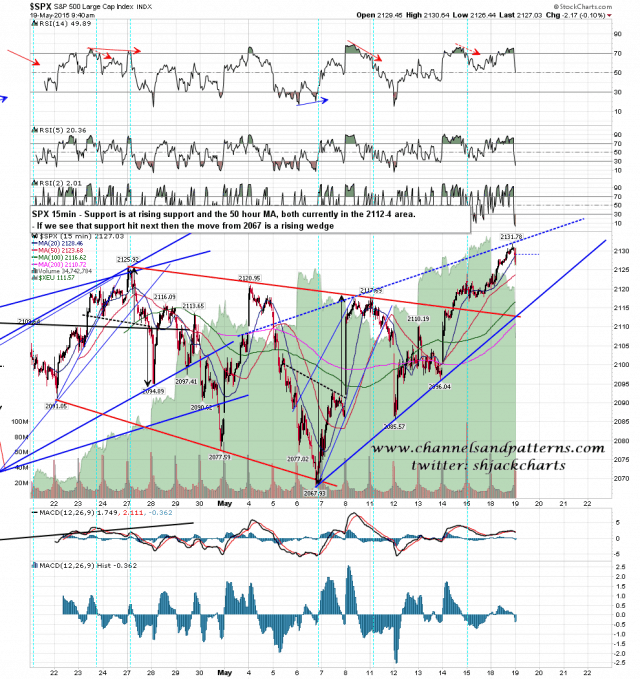

Short term the chart looks weak, with a 5min sell signal, a 15min sell signal not yet fixed, and a possible rising wedge resistance trendline hit at the high yesterday. That opens up a possible move to test rising support from 2067 and the 50 hour MA, currently in the 2012-4 area. A break below there should mean mean that the spring high has most likely been made, though it might still then be retested. SPX 15min chart:

If we see some strength today then I will be watching to see whether an upper band ride might be starting. If so I’d be expecting at least a test of the daily upper band at 2132 today. If an upper band ride gets established that could run SPX up through my preferred target area (up to broken rising wedge support) into higher options. SPX daily chart:

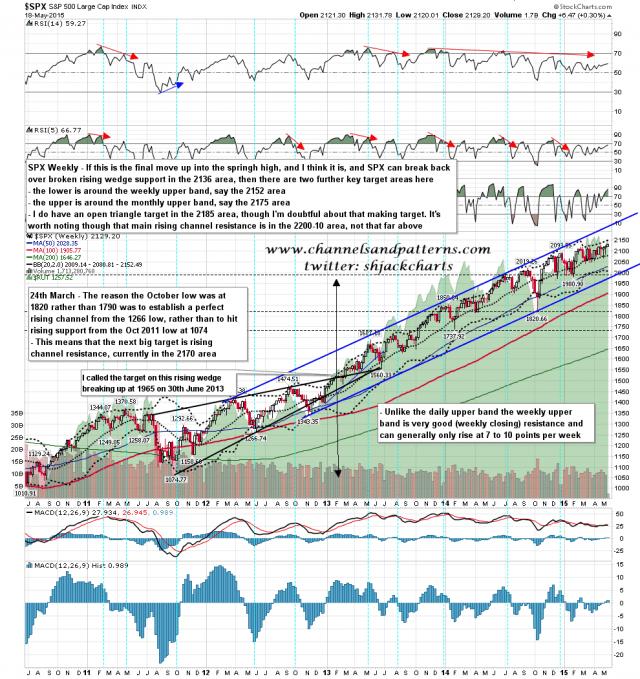

The higher options if we see a break up through 2136 are the weekly upper band at 2152, and the monthly upper band at 2175. There is an open triangle target at 2185 but that would risk a move over rising wedge resistance which would be very unusual at this stage. That would only happen on a breakup from the wedge generally, and with very strong primary rising channel resistance in the 2200-10 area, this wedge isn’t breaking up. SPX weekly chart:

Is the spring high in? Maybe, but if so then 2112-4 support needs to be broken. If we see that it’s very important to remember that the high might still then be retested to form a double top.