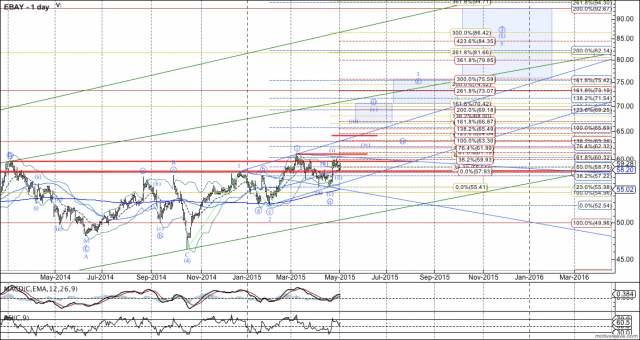

EBAY continues to hold a strong bullish position, with last week’s pullback having hit a 50% retrace of what I count as wave (i) of circle-iii. Ideally, that pullback was all of (ii), in which case red fibs provide upside extensions; however, further consolidation remains reasonably probable until the prior high of 60.93 is taken out.

Ideal support for any such further downside consolidation is 61.8% retrace of (i), at 57.32, and must-hold level is 55.41. On the upside, a break of 60.93 makes it likely that EBAY is in wave (iii) of circle-iii. However, Elliott Wave confirmation is not until the 1.0 extension of circle-i, at 64.26, is taken out (yellow fibs). This position remains one of my favorites in our model portfolio, and I view the setup as having a good chance of coming to fruition. Given channel resistance that EBAY has in the 63-64 range, I will consider reducing risk in that zone, though a final decision will depend on the stance in which EBAY approaches that resistance.

Originally published on ElliottWaveTrader.net, by Xenia Taoubina.