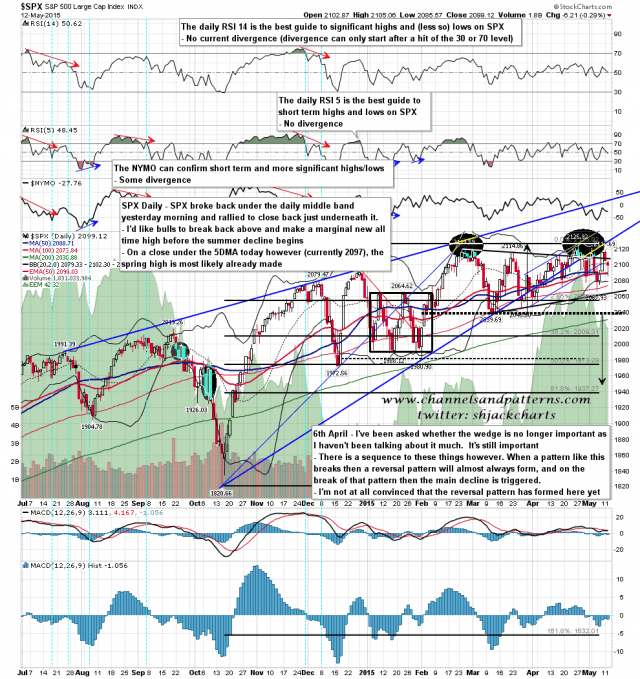

SPX gapped down hard below the daily middle band yesterday and rallied to close just under the middle band. What I would like to see now is a break back over the middle band, and then a fast move back to the daily upper band to make a marginal new all time high. I’d be looking for the 2015 high at that marginal new high, and would then be looking for a 300+ handle decline to retest the October low at 1820, with a rally on the way to establish an H&S right shoulder at the likely 1972 area neckline.

Will it play out that way? Only one way to find out but it’s the best fit for what I can see here. On the first trading day of February I observed that historically the best likely case for SPX in 2015 was a flat year, and nothing has changed relating to that since then in my view. SPX daily chart:

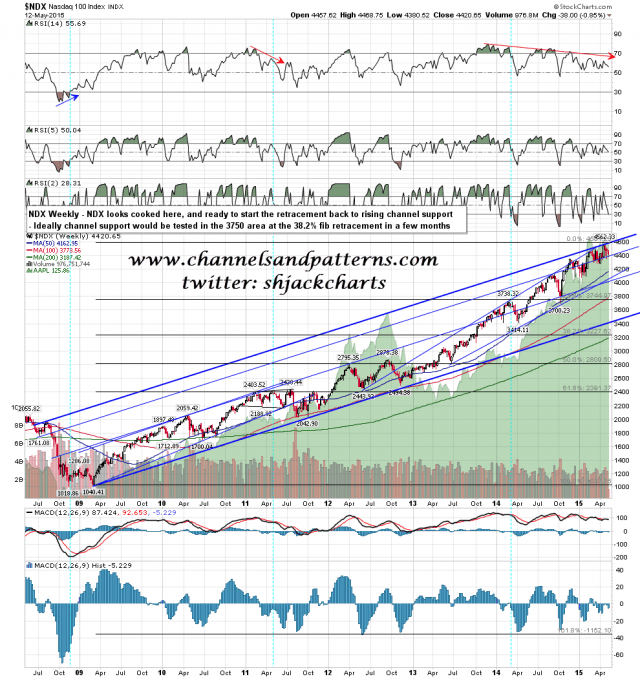

SPX looks cooked and ready to serve here, RUT too, and also NDX as shown on the chart below. The next big move should be down now. NDX weekly chart:

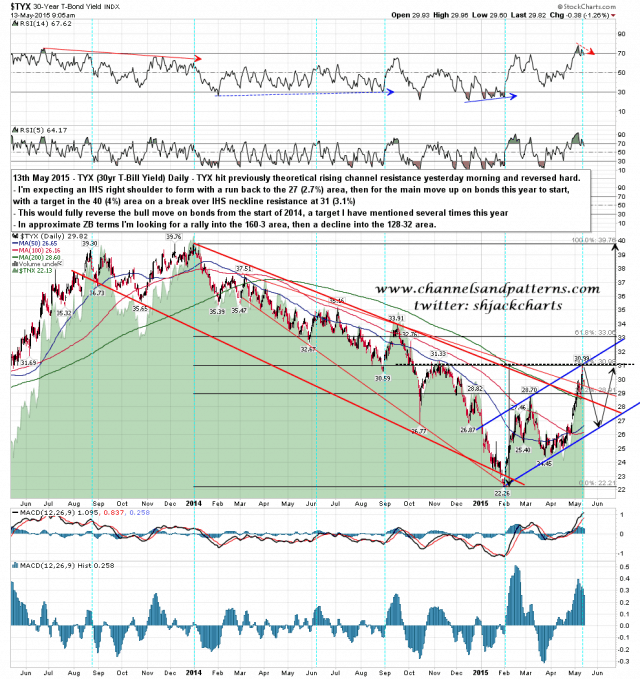

I hope that those of you who took the bonds short I suggested a few weeks ago have been having fun. I’m expecting a decent rally here before the main down on bonds for 2015 begins and I’ve marked up what I’m expecting to see on the TYX chart below. Obviously TYX is the 30 year yields chart, so it is inverted. In ZB terms the low at 151 may well be retested but I’m then expecting a rally into the 160-3 area, then a much larger decline to what would then be an H&S target in the 128-32 area. That move would entirely retrace all the gains made on bonds since the start of 2014, and would raise 30 year yields from 2.7% to 4% in the process. Don’t get caught on the wrong side of this move. TYX daily chart:

SPX is back over the daily middle band and I would like to see the final move to a marginal new all time high this week. If we see a close significantly under the 5 DMA (currently 2097) today then the spring high is most likely already made.