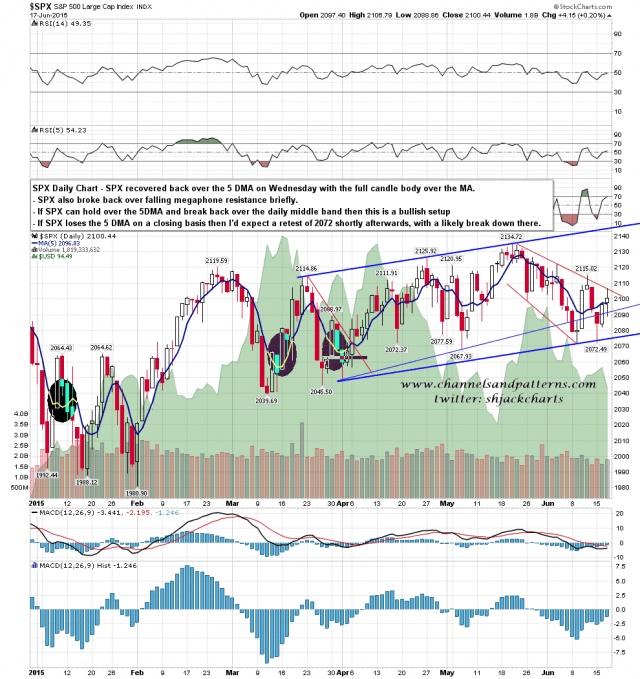

The bulls won FOMC on points yesterday, with a break back over the 5DMA, a test of the daily middle band, and a close on the 50 day EMA. Today they need to hold the 5 DMA (currently 2096) on a closing basis, with important support at the 50 hour MA just below at 2094.5. Above bulls need to break over the 50 DMA at 2104 and deliver a close more than a couple of handles over the daily middle band at 2106. If they can do that, then they can have a shot at retesting the all time high. SPX daily 5DMA chart:

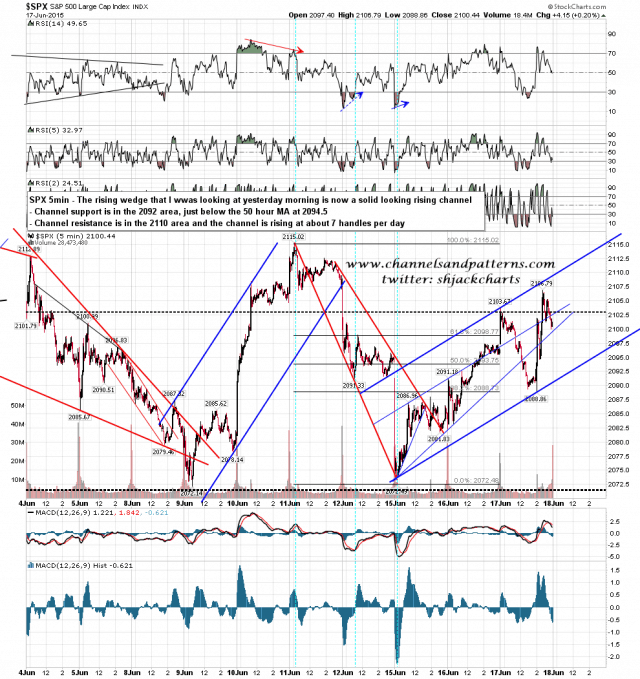

The short term pattern that I was looking at yesterday morning took my option 2 and has evolved into a rising channel. Channel support is in the 2092 area, slightly below the 50 hour MA at 2094.5. That is key support today. SPX 5min chart:

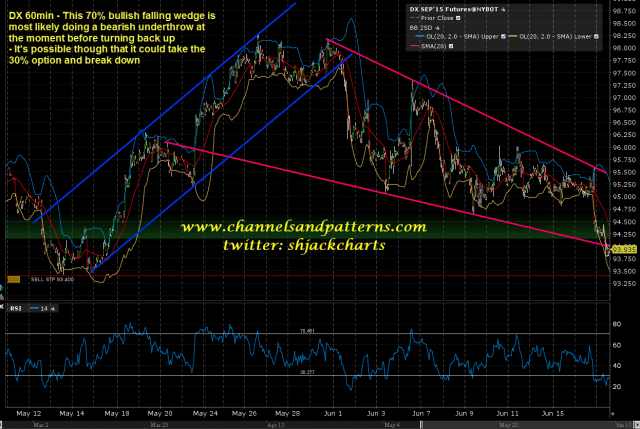

DX is at a big inflection point here with a lovely falling channel from the last high currently either doing a bullish underthrow for the 70% bullish option, or starting to break down for the 30% bearish option. I am currently assuming that DX will break up here and that CL and GC will break down with that. It could still go the other way though and I’ll be happier when DX is back over, and reliably holding over, 94. DX 60min chart:

Bulls have the short term trend and support and resistance are clear. May the strongest large and bad tempered animal win 🙂