I have an announcement today as I set up a new site at the weekend to cover my swing trading collaboration with fellow chartist Stan Nabozny. The site is at www.theartofchart.net, and I christened it yesterday with a post on bonds. I will be posting most of my, and our, work outside equity indices there in future.

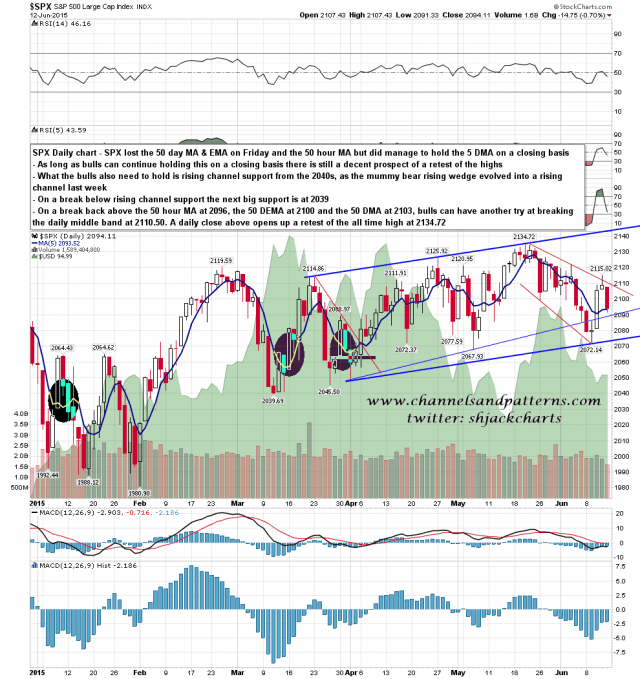

Bulls had a bad day on Friday and managed to lose support at the 50 day MA and EMA and at the 50 hour MA. They did however managed to hold on to the 5 day MA on a closing basis, and are still in with a shot at a retest of the highs at the moment, though the odds have worsened considerably. Support is at the 5 DMA at 2093.5 (closing basis) and rising wedge turned channel support in the 2073/4 area. Resistance is at the 50 hour MA at 2096, the 50 DEMA at 2100, and the 50 DMA at 2103. If bulls can break back above those (closing basis) then they can have another run at the daily middle band at 2110.50. If they can manage that then a retest of the all time high opens up. If they can’t then 2039 is the next obvious support. SPX daily chart:

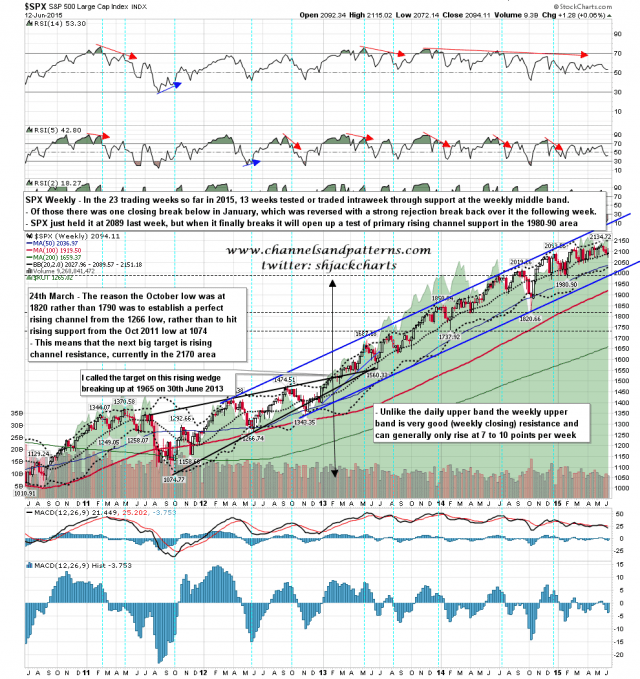

Not far under the close on Friday was the weekly middle band at 2089. That has been very important support so far this year, and has been tested in 13 of the 23 trading weeks since the start of the year. The open today has gapped below it and bulls need to fill that gap by the end of the week to avoid a breakaway candle through support. SPX weekly chart:

A very weak start to the day with the move to 2074, but I would note that rising channel support has held at the current low. On the bull scenario 2073/4 has to continue holding so if SPX returns to break below then I’d expect to see continuation down. Right now however, this is a possible higher low.