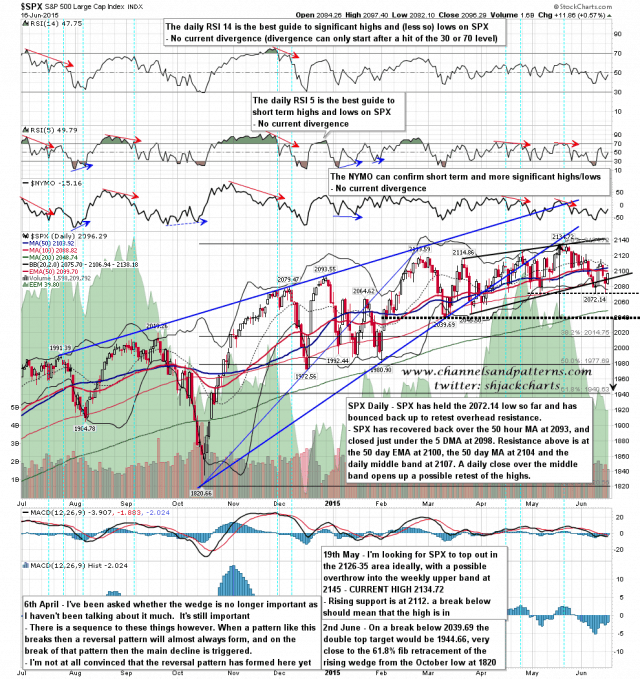

SPX has held the 2072.14 low and has returned to retest the resistance levels broken late last week and then surrendered on Monday. SPX closed back over the 50 hour MA at 2092.7 yesterday, and just under the 5 DMA at 2098. Above there resistance is at the 50 day EMA at 2100, the 50 day MA at 2104 and the daily middle band at 2107. A close back over the daily middle band opens the door to retest the all time high at 2134. SPX daily chart:

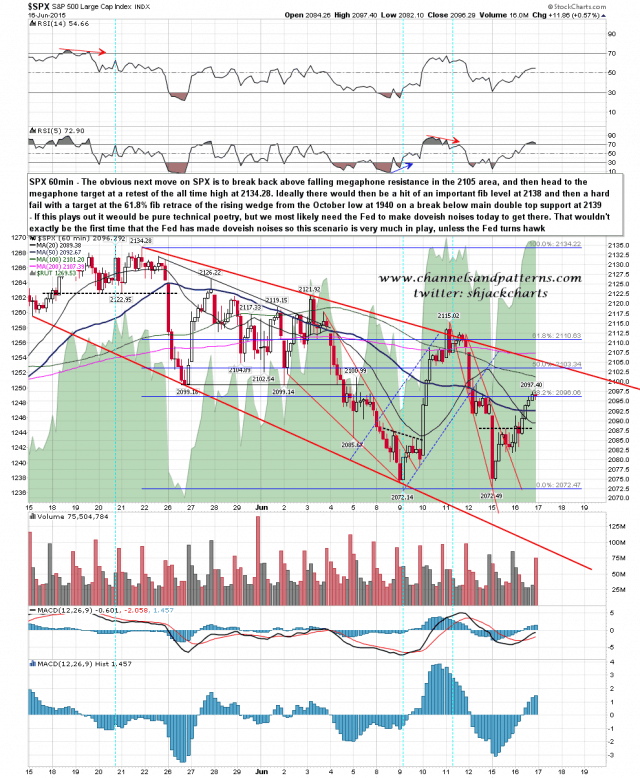

On the 60min chart the 50 hour MA at 2092.7 is now important support and bulls want to break back over falling megaphone resistance in the 2105 area to trigger the megaphone target at a retest of 2134. SPX 60min chart:

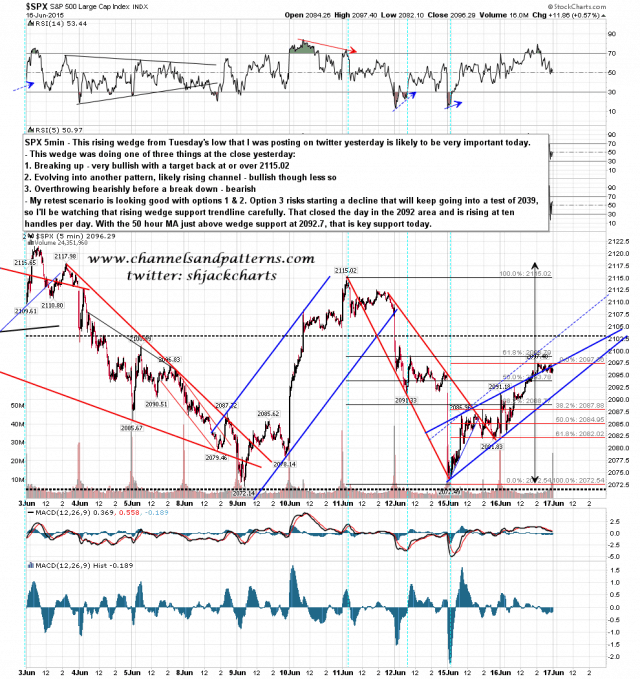

The clock is ticking here though. The rising wedge on the 5min chart that I was posting on twitter yesterday afternoon is either:

1. Breaking up towards a target at or above 2115 – bullish

2. Evolving into a rising channel – bullish but less so

3. Breaking down next after a bearish overthrow – bearish

Bulls need to hold that rising wedge support as a break below would deliver a retracement that might well just keep going down and kill off the highs retest scenario. That rising wedge support is now at 2092 and rising at ten handles per day. SPX 5min chart:

I still like the highs retest scenario here. All the Fed needs to do today is make some soothing noises and sprinkle a bit of dove guano over the market to deliver a last move up into my ideal target and short entry at the important fib level at 2138. The Fed has made doveish statements on occasion in the past and I’m looking for that again today. If the Fed comes across as hawkish instead the retest is most likely not going to happen.