The Greek referendum was a clear vote against further austerity and we should see this week whether the ECB bluff that the Greeks have called is in fact a bluff. I suspect it isn’t and that a grexit is now the most likely outcome. If so then I think that’s great news for the Greeks, who can finally default and start rebuilding. It’s a rare country that still has a shrinking economy a couple of years after default. If that’s the way it goes then it would nice for that to be quick, as the constant headlines have become a serious bore.

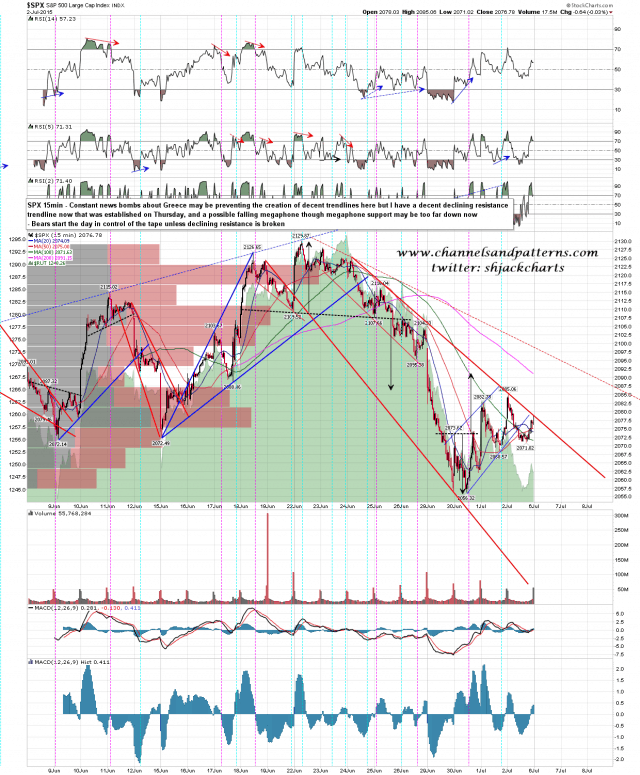

SPX hasn’t been generous with trendlines since the last high. I do now have a three touch resistance trendline established on Thursday and I’ll be watching to see whether that survives the day. As long as it survives my lean is bearish. SPX 15min chart: