“Gold’s going to $1000, it’s very clear from the charts.”

“Gold has to hit $800 before it finds a bottom.”

I’m here to call you on that $800 prediction, and in fact go you one better: gold is going to drop at least $400, and possibly more. No, I’m not trying to one-up all of the dire numbers various pundits have thrown out as to where the price of gold will eventually reach. Nor am I claiming that bearishness has reached a climax, and secretly hoping this is The Bottom. In fact, I don’t even believe the analysis I’m about to present is correct. So why bother to write a few hundred words about something I don’t agree with? Simply because I have been investing in gold for over 12 years, and as a prudent investor it’s vital that I consider bearish as well as bullish scenarios in my investment.

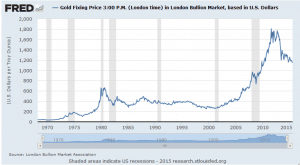

When I began buying gold and gold stocks in 2003, there were already people saying it was in a bubble. The price of gold had been as low as $250 in 1999, and had risen steadily to $350 in 2003. But the bearishness towards gold was palpable, miners were hedging left and right, and most people thought gold would quickly head back to the $200s. As a true contrarian, I bought in heavily (and some might say stupidly).

Price of Gold, Daily PM London Fixing

To manage my investment, I needed to know if gold was “cheap” or “expensive”, and to come up with reasonable price targets. I did a back-of-the-envelope calculation, and arrived at a “fundamental” price for gold of $750. (My notes on the calculations are long gone, so I can only recall the result.) A recent paper by Claude Erb, “The Golden Dilemma”, posits a fair price for gold of around $800, amazingly close to my $750 target after adjusting for 10 years of inflation. The paper is worth reading. The SSRN link is not free since this was a NBER paper, but there is (or at least was) a free version at http://www.columbeurs.com/wp-content/uploads/2013/02/SSRN-id2078535.pdf

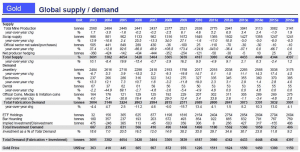

Comparing the $250 price gold traded at in 1999 to my calculated fundamental price of $750 in 2003, gold had dropped to one-third of its fair value, and was quite undervalued, even at $350. Gold’s price is driven mostly by speculators, as most of the world’s supply is hoarded and only a small fraction is actually used in jewelry or technology applications.

Gold supply and demand

(Keep in mind there are already more than 180,000 tonnes of gold in existing stockpiles before comparing the yearly jewelry/electronics demand to the investment demand.)

Assuming gold was truly in a bubble, since gold had undershot fair value by a factor of three, I assumed gold would eventually overshoot fair value also by a factor of three. Therefore, I was able to guess an eventual price target of 3 x $750, or $2250, give or take a few hundred dollars.

Now we come to the crux of the issue; which of these statements is the most likely to be correct?

- Did a gold bubble peak at $1900 in 2011, some $350 below my price target?

- Or possibly gold never reached bubble levels of speculation and wimped out well below the level it “should” by all rights have reached?

- Or, gold is just taking a breather, retracing and correcting to some intermediate level before turning around and heading back towards my price target?

And now you see why I am presenting this analysis. I stand by my conviction of a $2250 price target for the time being with scenario 3), but there must be some as yet undetermined gold price that will convince me that I am wrong, and either scenario 1) or 2) is correct. And if either of those scenarios is indeed correct, then the price of gold must fall to at least its fundamental value of around $750, or more likely, speculative forces will again drive it well below the fair price, possibly as low as $300 to $400. A dilemma indeed.

A couple of further thoughts:

- In true bubbles, after a major correction and bottom have occurred, it’s not unusual for the price to take off violently, leaving the majority of investors behind. (The scenario I am expecting.)

- Prudent risk management demanded that I sell off parts of my investment as intermediate peaks show themselves, which I did periodically. My analysis could always have been wrong, and it’s stupid to blindly follow numbers that are not much better than guesses. So I am left with a much smaller stake than I otherwise would have, but I haven’t given up, yet.