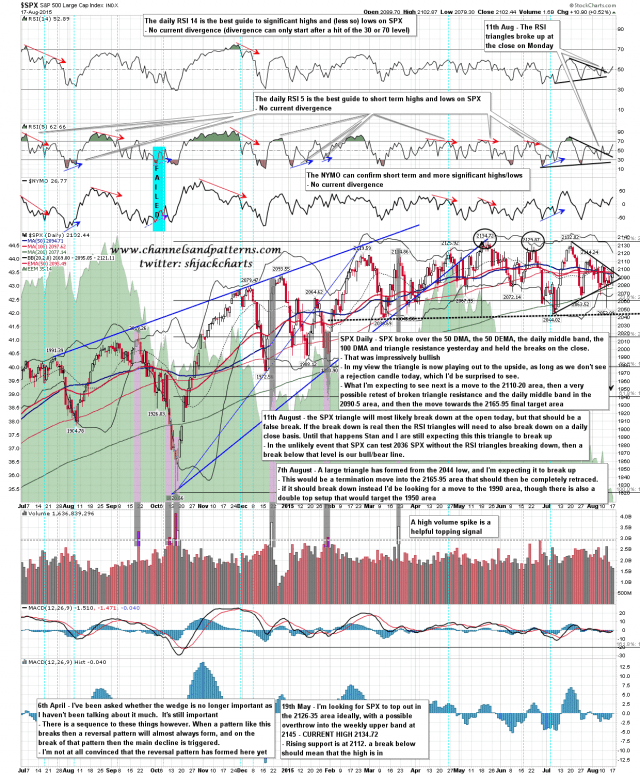

Yesterday’s little double top failed at the 38.2% fib retrace and we saw the move up afterwards that I was looking for. In a move that was really impressively bullish SPX then powered through the 50 DMA, 50 DEMA, daily mid band, 100 DMA and triangle resistance, closing above all of them. Unless we see a reversal candle today I am working on the assumption that the triangle is now breaking up towards the 2165-95 target area, though in terms of the expected path I’d like to see a short term high in the 2110-20 area, then a retest of triangle resistance, daily mid band and the 50 hour MA in the 2090-5 area, then the main move up towards the 2165-95 target area.

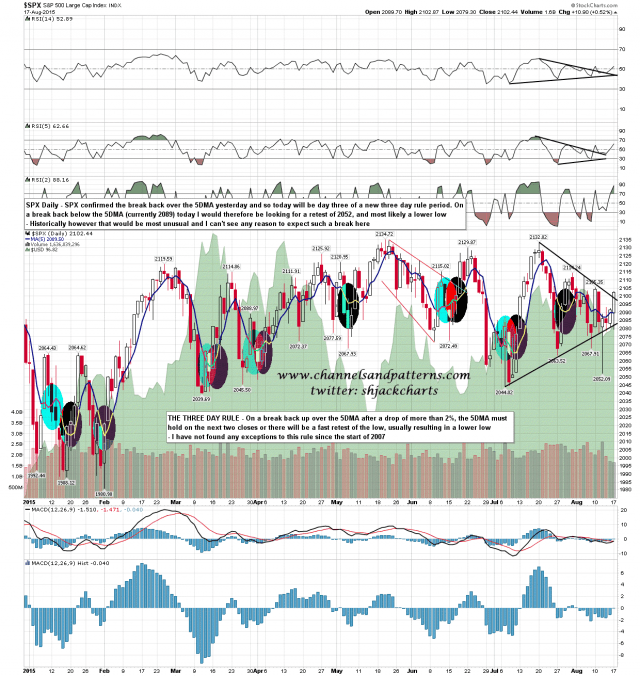

As the 5 DMA has been broken again, SPX is on day three of the 5 DMA three day rule. the 5 DMA must hold as closing support today to avoid a likely retest of the 2052 low. I’m not expecting to see that though. SPX daily 5 DMA chart:

For intraday support I’d like to see the daily mid band at 2095 hold as support and would be getting seriously concerned about a break back down on a break below the 50 hour MA at 2085. SPX daily chart:

I’m definitely leaning bullish today. I’m looking for an AM low to buy ideally and then a continuation of yesterday’s move up.