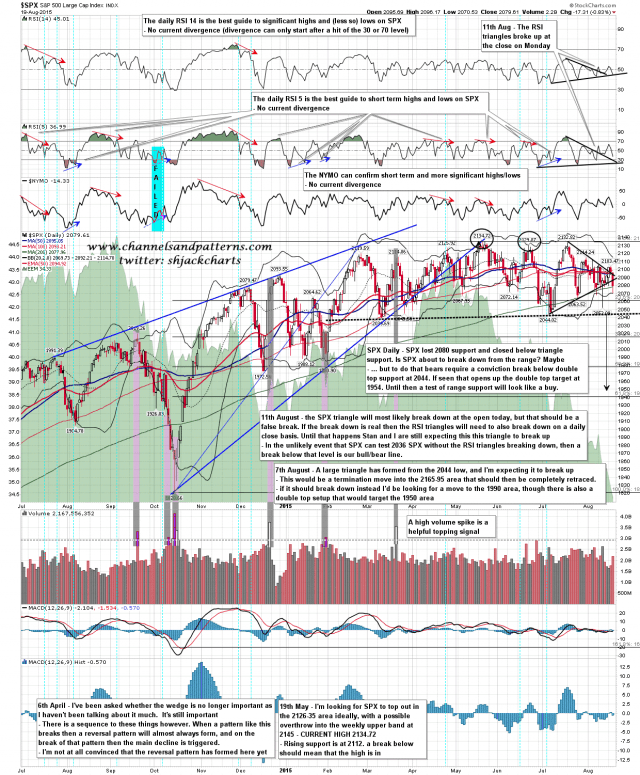

A bad day for the bulls yesterday with 2080 support lost hard twice during the day and a close well under triangle support. Advantage bears for the moment, and they could get a run down to test range and double top support at 2044.

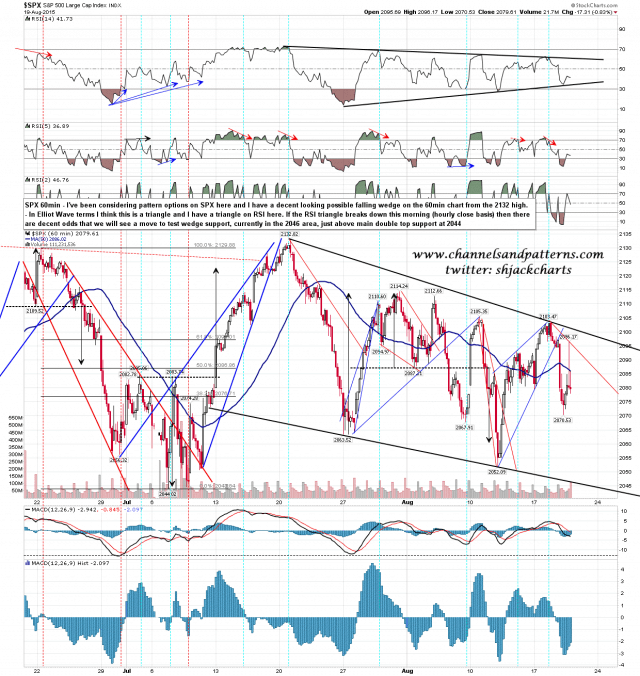

I’ve been having a careful look at the SPX pattern structure and I have a possible falling wedge from 2132 forming here. This is mirrored by a triangle on the RSI 14 and if we see an hourly close below that this morning then that would open up a test of wedge support, currently in the 2046 area, just above the key 2044 support level. SPX 60min chart:

The must hold hold level for bulls here is 2044.02. Any print below damages the bull case and a sustained break below should kill it, opening up the double top target at 2054. SPX daily chart:

Bulls are on must perform today. If they can hold 2044.02 then they still have a decent shot. If they lose that support level then I’d expect to see 1950s soon. Meantime Stan and I are both still leaning long here.