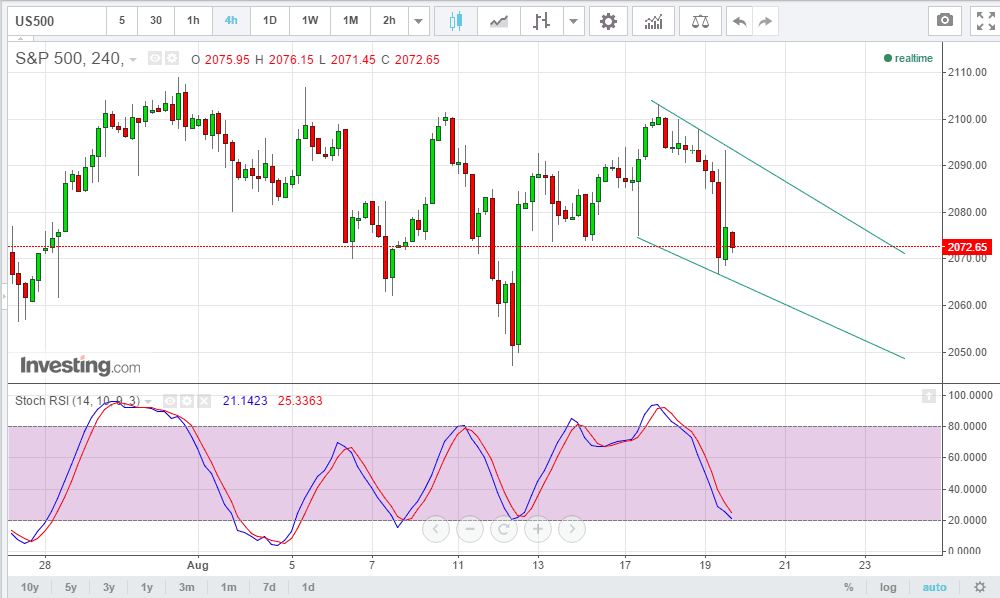

My preferred time frame to check market direction is the four chart. I attached a chart for your reference. Also I only care about momentum, and trendlines to guide me.

As you can see, this gives me a good framework to determine my bullish or bearish leanings.

Yesterday and today, I was watching for a bearish swing after the 2100 area failed, and with momentum receding. We got it, in spades. I then extended the trendlines to let me know when to abandon this bearish tilt, and watched as the market traded up to the downtrend line, and failed, and momentum rolled over at the same time a four hour crossed over, and went short.

I then covered expecting a end of the day ramp, so traded on the five minute signal, and saw that momentum was waning and went short again, right at the close, (79.50).

That is just a preamble for the set up. Now that we failed, I will now watch for the bottom trendline for a failure of that trendline. I am reasonably confident it will fail, as when momentum goes below 20, it gets stuck on sold until momentum fights back above. My view is we are going to test support at the August low. Then will watch the July low.

My mind changes at a move above 20 on momentum, and / or a break above the upper trendline.

I keep it as simple as this. Enjoy.