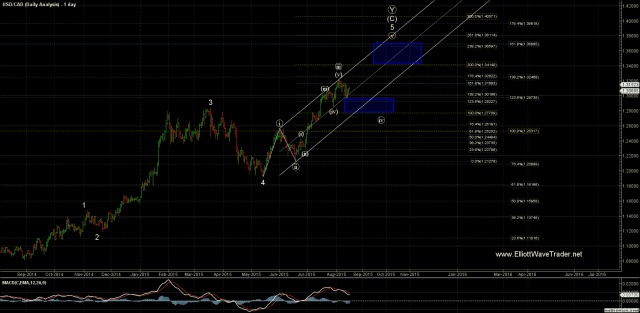

The May 14th low in the USD/CAD counts best as the bottom of a large degree wave 4. The rally that we have seen that made a local top on August 4th counts as a very clear 3 wave structure so far. This leaves us looking for another high to complete our wave five wave structure off of the May 14th low.

Now while the pattern certainly does suggest that we should see new highs into the later part of the year the overall structure of the pattern ideally should see lower levels before heading higher into the final wave ((v)) up. These lower support levels currently come in at 1.2956 – 1.2770 which is shown on the chart in the form of a blue box, this is our buy zone. As long as we remain over the lower support level of 1.2770 then the probabilities are good that we will see new highs into the 1.3414 level with possible extensions into the 1.3688 level, these are our sell zones. Should we break under the 1.2770 level the count will still remain valid, however the probabilities of seeing follow-through to the upside under this count are reduced. A break under the 1.2563 level would invalidate this count and suggest that we may have made a more complex top on August 4th. This is the level that we would stop out of our trade.

Also of note is a possible alternate scenario that would suggest that we see new highs directly from current levels. This alternate count is shown in yellow on the chart however at this time it is a lower probability scenario due the structure of the overall pattern and the corrective nature of the move off of the August 12th low. Again this is not a highly probable count at this time; however, it is something that we have on our radar should we break to new highs from here.